Navigating the world of commercial loans can be a daunting task, especially for those unfamiliar with the intricacies of loan agreements and financial jargon. This guide aims to demystify the process, providing a comprehensive understanding of commercial loan terms and conditions, from the initial application to managing repayment obligations.

From understanding interest rates and loan terms to deciphering loan covenants and navigating the application process, we will explore key aspects that every borrower should be aware of. Whether you are a seasoned entrepreneur seeking expansion capital or a startup seeking funding for your first venture, this guide will equip you with the knowledge to make informed decisions and secure the best possible loan terms.

Loan Application Process

Securing a commercial loan is a crucial step for many businesses. The application process involves a series of steps designed to assess your business’s financial health and its ability to repay the loan.

Steps in the Application Process

The application process for a commercial loan typically involves the following steps:

- Initial Contact: You’ll begin by contacting a lender, either directly or through a loan broker, to express your interest in a commercial loan. During this initial contact, you’ll discuss your business needs, desired loan amount, and potential loan terms.

- Loan Application: The lender will provide you with a loan application form. This form will ask for detailed information about your business, including its financial history, current operations, and future projections.

- Document Gathering: Once you’ve submitted the application, the lender will request supporting documentation to verify the information you provided. This documentation typically includes:

- Financial Statements: Recent balance sheets, income statements, and cash flow statements.

- Tax Returns: Recent business tax returns.

- Business Plan: A detailed document outlining your business’s goals, strategies, and financial projections.

- Personal Financial Information: Credit reports and personal financial statements for business owners.

- Collateral Information: Details about any assets you are using as collateral for the loan.

- Other Documents: Depending on the specific loan type, the lender may request additional documentation, such as contracts, leases, or insurance policies.

- Creditworthiness Assessment: The lender will carefully analyze your financial information and credit history to assess your creditworthiness. This assessment will consider factors such as your debt-to-income ratio, credit score, and payment history.

- Loan Approval or Denial: Based on the information gathered and the lender’s assessment of your creditworthiness, the lender will decide whether to approve or deny your loan application.

- Loan Closing: If your loan application is approved, you will work with the lender to finalize the loan terms and sign the loan agreement. This process may involve legal counsel and other professionals to ensure the loan documents are accurate and meet your needs.

Key Documents and Information

The lender will use the information you provide to assess your creditworthiness and determine the loan terms.

“Lenders look for strong financial performance, a solid track record of managing debt, and a clear understanding of your business’s future prospects.”

Creditworthiness and Financial History

Your creditworthiness is a key factor in the loan approval process. Lenders will consider your credit score, payment history, and debt-to-income ratio to determine your ability to repay the loan. A strong credit history demonstrates that you are a responsible borrower, making you a more attractive candidate for a loan.

Understanding Loan Agreements

A loan agreement is a legally binding contract between a lender and a borrower outlining the terms and conditions of the loan. Carefully reviewing the loan agreement is crucial for borrowers to understand their obligations and protect their financial interests.

Key Sections of a Loan Agreement

Understanding the key sections of a loan agreement is essential for borrowers to make informed decisions. These sections provide detailed information about the loan, including:

- Loan Amount and Purpose: This section specifies the total amount of the loan and the intended use of the funds.

- Interest Rate and Payment Schedule: This section details the interest rate applied to the loan, whether it is fixed or variable, and the payment schedule (e.g., monthly, quarterly).

- Loan Term and Maturity Date: This section Artikels the duration of the loan and the date when the loan is expected to be fully repaid.

- Collateral and Security: This section specifies any assets pledged as collateral to secure the loan. If the borrower defaults on the loan, the lender has the right to seize the collateral.

- Default and Remedies: This section Artikels the circumstances that constitute a default on the loan and the lender’s remedies in such situations.

- Prepayment and Late Payment Penalties: This section specifies any penalties associated with early repayment or late payments.

- Governing Law and Dispute Resolution: This section Artikels the applicable law governing the loan agreement and the process for resolving disputes.

Implications of Different Loan Structures

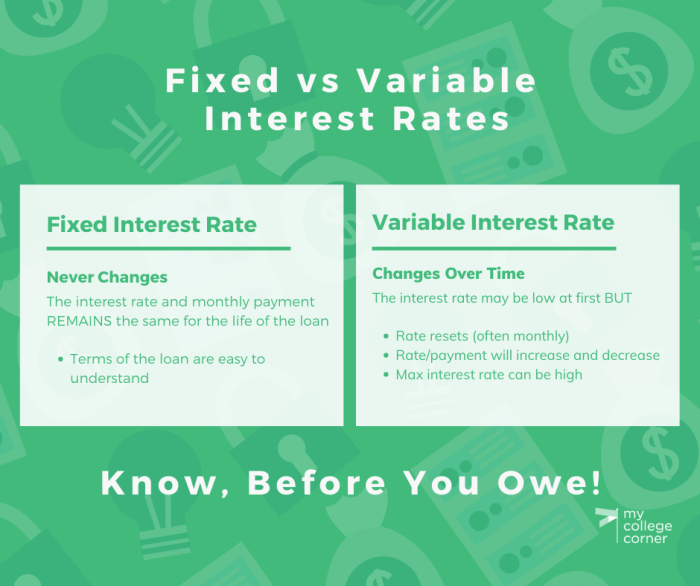

The structure of a loan can significantly impact the borrower’s financial obligations. Two common loan structures are fixed-rate loans and variable-rate loans.

Fixed-Rate Loans

- Interest Rate: The interest rate remains constant throughout the loan term.

- Predictability: Fixed-rate loans offer predictability, as borrowers know exactly how much interest they will pay each month.

- Stability: Fixed-rate loans provide stability during periods of rising interest rates, as the interest rate remains fixed.

Variable-Rate Loans

- Interest Rate: The interest rate fluctuates based on a benchmark rate, such as the prime rate or LIBOR.

- Potential for Savings: Variable-rate loans can offer lower initial interest rates compared to fixed-rate loans.

- Risk of Higher Payments: If benchmark rates rise, the interest rate on a variable-rate loan will increase, potentially leading to higher monthly payments.

“Choosing between a fixed-rate and variable-rate loan depends on individual circumstances and risk tolerance. Borrowers should carefully consider their financial situation and future interest rate expectations.”

Managing Loan Obligations

Taking out a commercial loan is a significant financial commitment. It’s essential to have a solid understanding of your loan obligations and develop a plan to manage them effectively. This ensures you can meet your repayment deadlines, minimize interest costs, and maintain a healthy financial standing.

Making Timely Payments

Making timely loan payments is crucial for maintaining a good credit score and avoiding penalties. Late payments can result in higher interest rates, late fees, and even loan default. Here’s how to ensure you make your payments on time:

- Set Up Automatic Payments: Automate your loan payments to avoid missing deadlines. Most lenders offer this option, allowing you to schedule recurring payments from your bank account.

- Use a Payment Reminder System: Set reminders on your phone, calendar, or use a budgeting app to stay on top of your payment due dates.

- Keep Track of Your Loan Terms: Familiarize yourself with your loan agreement, including the repayment schedule, interest rate, and any applicable fees. This helps you anticipate upcoming payments and avoid surprises.

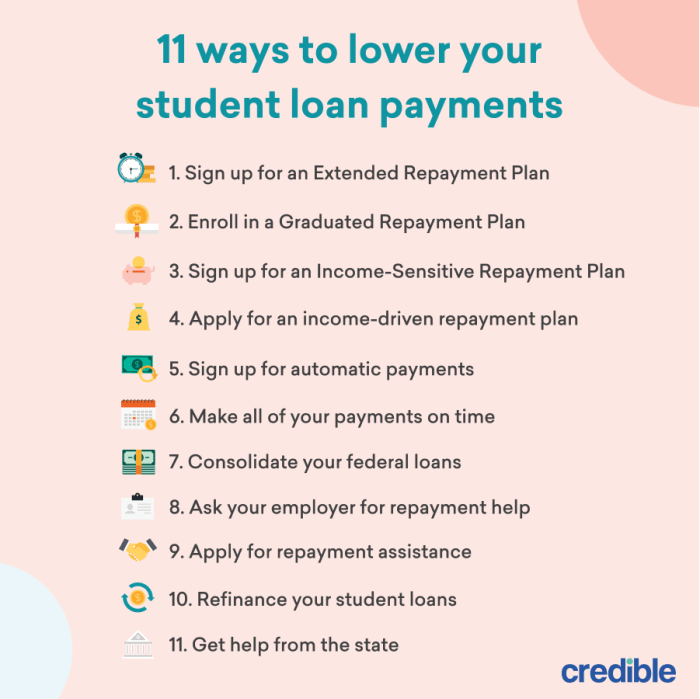

Strategies for Minimizing Interest Costs

Interest payments can significantly impact the overall cost of your loan. By implementing effective strategies, you can minimize these costs and save money over the loan’s term.

- Make Extra Payments: Whenever possible, make additional payments beyond your regular monthly installments. These extra payments reduce your principal balance faster, leading to lower overall interest charges.

- Refinance Your Loan: If interest rates fall after you’ve taken out your loan, refinancing can help you secure a lower rate and reduce your monthly payments. However, remember that refinancing may involve fees, so carefully assess the potential savings before making a decision.

- Negotiate with Your Lender: If you’re facing financial difficulties, contact your lender and discuss possible options for modifying your loan terms. They may be willing to adjust the repayment schedule or reduce the interest rate to help you stay current on your payments.

Understanding Loan Default

Loan default occurs when you fail to meet your loan obligations, such as missing payments or violating the terms of your agreement. Defaulting on a loan can have serious consequences, including:

- Damage to Your Credit Score: Defaulting on a loan significantly harms your credit score, making it harder to obtain future loans or credit cards.

- Legal Action: Lenders can take legal action to recover the outstanding debt, which could include lawsuits, wage garnishment, or property seizure.

- Loss of Collateral: If your loan is secured by collateral, such as property or equipment, the lender may seize and sell it to recover the debt.

Preventing Loan Default

Avoiding loan default is crucial for maintaining your financial well-being. Here are some steps you can take to prevent this situation:

- Budget Carefully: Create a realistic budget that includes your loan payments and other essential expenses. This helps you track your income and expenses, ensuring you can afford your loan obligations.

- Maintain Emergency Savings: Having an emergency fund can provide a financial cushion in case of unexpected events, such as job loss or medical emergencies. This helps you avoid falling behind on your loan payments.

- Communicate with Your Lender: If you anticipate difficulty making your payments, contact your lender immediately. They may be willing to work with you to find a solution, such as modifying your loan terms or offering temporary forbearance.

Comparing Loan Options

Choosing the right commercial loan is crucial for your business’s success. It involves understanding the different loan options available and their unique features. This section will guide you through comparing various commercial loan options to find the one that best suits your business needs.

Comparing Loan Options

Each commercial loan option comes with its own set of features and requirements. Understanding these differences can help you make an informed decision.

| Loan Type | Interest Rate | Loan Term | Eligibility Requirements | Other Factors |

|---|---|---|---|---|

| Term Loan | Fixed or variable | 1-25 years | Good credit history, strong financial statements | Regular payments, potential collateral requirements |

| Line of Credit | Variable | Typically revolving | Good credit history, strong financial statements | Flexible borrowing, interest only payments |

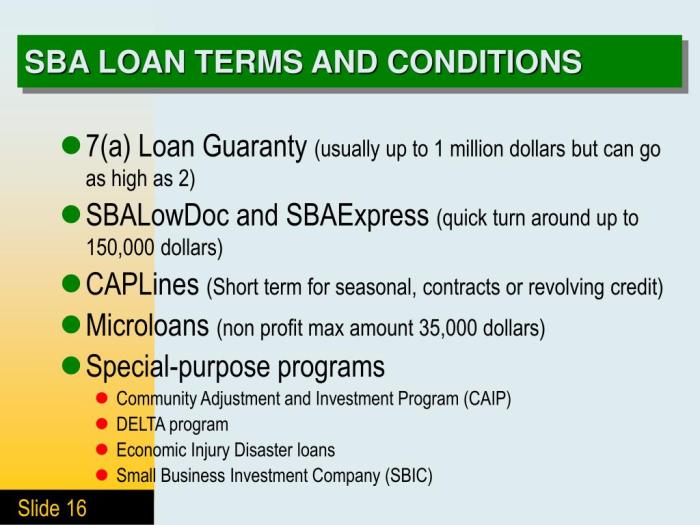

| SBA Loan | Competitive rates | Up to 25 years | Small business ownership, good credit history | Government-backed, lower down payments |

| Equipment Loan | Fixed or variable | 5-15 years | Good credit history, strong financial statements | Collateral is the equipment being financed |

| Invoice Financing | Variable | Short-term | Good credit history, strong financial statements | Based on outstanding invoices, quick funding |

This table provides a general overview of common commercial loan options. Specific terms and conditions may vary depending on the lender and your individual circumstances. It’s essential to thoroughly research each loan option and compare them based on your business’s unique needs and financial situation.

Examples of Loan Products

Here are some examples of specific loan products offered by different lenders:

- Bank of America: Business Advantage Loan, Business Term Loan, SBA Loan, Equipment Finance

- Wells Fargo: Business Line of Credit, Business Term Loan, SBA Loan, Equipment Finance

- Chase: Business Loan, Business Line of Credit, SBA Loan, Equipment Finance

- Small Business Administration (SBA): 7(a) Loan, 504 Loan, Microloan

- Online Lenders: Kabbage, OnDeck, LendingClub, PayPal Working Capital

This list provides a sample of loan products offered by different lenders. You can find more detailed information about specific loan products by visiting the lenders’ websites or contacting them directly.

Selecting the Right Loan Option

The best loan option for your business depends on various factors, including:

- Your business’s financial situation: Your credit score, revenue, and cash flow will determine your eligibility for different loans and the interest rates you qualify for.

- The purpose of the loan: Different loan types are suitable for specific purposes. For example, a term loan is suitable for long-term investments, while a line of credit is ideal for short-term working capital needs.

- Your repayment capacity: Ensure you can comfortably repay the loan based on your projected cash flow and income.

- The loan terms: Compare interest rates, loan terms, fees, and other conditions to find the most favorable option.

It’s highly recommended to consult with a financial advisor or loan officer to determine the best loan option for your business.

By understanding the fundamental concepts and navigating the complexities of commercial loan agreements, borrowers can secure financing that aligns with their business needs and goals. This guide serves as a valuable resource for navigating the intricacies of commercial loans, empowering you to make informed decisions and achieve financial success.

Question Bank

What is the difference between a fixed and variable interest rate?

A fixed interest rate remains constant throughout the loan term, providing predictable monthly payments. A variable interest rate fluctuates based on market conditions, leading to potential changes in monthly payments.

What are loan covenants, and why are they important?

Loan covenants are specific agreements between the lender and borrower outlining certain financial conditions or actions the borrower must adhere to. These covenants protect the lender’s interests and ensure the borrower’s ability to repay the loan.

What are some common reasons for loan default?

Common reasons for loan default include failure to make timely payments, violation of loan covenants, business downturn, or unforeseen circumstances. It’s crucial to maintain strong financial management practices and proactively address any potential challenges.

How can I improve my creditworthiness for a commercial loan?

Improving your creditworthiness involves establishing a positive credit history, maintaining a low debt-to-income ratio, and demonstrating a strong financial track record. Building relationships with lenders and demonstrating a solid business plan can also enhance your creditworthiness.

What are some alternative financing options besides commercial loans?

Alternative financing options include equity financing, crowdfunding, government grants, and lines of credit. The best option depends on your specific business needs and financial situation.