Investing in new equipment can be a game-changer for businesses, but securing the necessary funds can be a challenge. Commercial loans offer a viable solution for financing equipment purchases, allowing businesses to acquire the tools they need to grow and thrive. This comprehensive guide will explore the intricacies of using commercial loans for equipment financing, providing insights into the process, key considerations, and alternative financing options.

From understanding eligibility requirements and navigating the loan application process to evaluating loan offers and managing repayments, this guide will equip you with the knowledge and strategies to make informed decisions when utilizing commercial loans for equipment financing.

Understanding Commercial Loans for Equipment Financing

Commercial loans play a crucial role in helping businesses acquire essential equipment for operations. They offer a flexible and accessible way to finance large purchases, enabling businesses to invest in their growth and efficiency.

Types of Commercial Loans for Equipment Financing

Commercial loans come in various forms, each designed to meet specific needs and circumstances. Here are some common types:

- Term Loans: Term loans are a fixed-term loan with a predetermined repayment schedule, typically with equal monthly installments. They offer a predictable payment structure and are suitable for financing larger equipment purchases. For example, a business could use a term loan to finance the purchase of a new delivery truck or manufacturing machinery.

- Lines of Credit: Lines of credit provide businesses with a revolving credit facility, allowing them to borrow funds as needed up to a pre-approved limit. This flexibility makes them ideal for financing smaller equipment purchases or covering unexpected expenses. A business could utilize a line of credit to finance the purchase of a new computer system or to cover repairs for existing equipment.

- Equipment Loans: Equipment loans are specifically designed to finance the purchase of equipment. These loans often come with lower interest rates and flexible repayment terms, making them attractive for businesses seeking dedicated financing for equipment acquisition. For instance, a business could use an equipment loan to finance the purchase of a new forklift or a specialized piece of manufacturing equipment.

- Lease Financing: Leasing allows businesses to use equipment without owning it. Instead of purchasing the equipment outright, businesses make regular payments to the lessor for the right to use it. This option can be beneficial for businesses that prefer predictable monthly payments and don’t want to tie up capital in asset ownership. For example, a business could lease a delivery van to avoid the upfront cost of purchasing it, while still enjoying the benefits of using the vehicle.

Advantages of Using Commercial Loans for Equipment Financing

Commercial loans offer several advantages for businesses seeking to finance equipment purchases:

- Access to Capital: Commercial loans provide businesses with the necessary funds to acquire equipment that might otherwise be out of reach. This access to capital allows businesses to invest in their growth and efficiency, leading to increased productivity and profitability.

- Tax Benefits: Interest payments on commercial loans are often tax-deductible, providing businesses with potential tax savings. This deduction can help offset the cost of borrowing, making equipment financing more affordable.

- Predictable Payments: Term loans and equipment loans typically have fixed monthly payments, providing businesses with a predictable cash flow and making budgeting easier.

- Flexibility: Lines of credit offer businesses flexibility in accessing funds as needed, allowing them to respond to changing business needs and opportunities.

Disadvantages of Using Commercial Loans for Equipment Financing

While commercial loans offer significant benefits, they also come with some potential drawbacks:

- Interest Costs: Borrowing money through commercial loans comes with interest charges, which can increase the overall cost of equipment financing. Businesses need to carefully consider the interest rate and repayment terms before committing to a loan.

- Credit Requirements: Lenders typically have strict credit requirements for commercial loans. Businesses with poor credit history or limited financial resources may find it challenging to secure financing.

- Collateral: Lenders often require collateral, such as equipment or real estate, to secure commercial loans. This can limit the borrowing options for businesses with limited assets.

Eligibility and Requirements for Commercial Equipment Loans

Securing a commercial equipment loan involves meeting specific eligibility criteria and providing essential documentation. Lenders evaluate your business’s financial health, creditworthiness, and the loan’s purpose to determine your suitability for financing.

Eligibility Criteria

Lenders typically consider several factors to assess your eligibility for a commercial equipment loan. These criteria help them gauge your ability to repay the loan and minimize their risk.

- Good Credit Score: Lenders prefer borrowers with a strong credit history, reflected in a high credit score. This demonstrates responsible financial management and reduces the lender’s risk of default.

- Established Business: Having a well-established business with a track record of profitability is crucial. Lenders want to see consistent revenue and a stable financial history.

- Sufficient Collateral: The equipment you’re financing often serves as collateral for the loan. Lenders may require additional collateral, such as real estate or other assets, to secure the loan.

- Loan Purpose: Lenders evaluate the purpose of the loan and how it aligns with your business’s growth strategy. They want to ensure the equipment is a sound investment for your business.

Required Documentation

To apply for a commercial equipment loan, lenders will typically require various documents to verify your financial information and assess your creditworthiness.

- Business Plan: A comprehensive business plan outlining your company’s goals, strategies, and financial projections. This document demonstrates your understanding of the market, your competitive edge, and your ability to manage the loan.

- Financial Statements: Recent balance sheets, income statements, and cash flow statements showcasing your business’s financial performance. These documents provide lenders with insights into your revenue, expenses, and overall financial health.

- Tax Returns: Copies of your business’s tax returns for the past few years to verify your income and profitability.

- Personal Financial Statements: If you’re applying for a loan as a sole proprietor or partnership, you may need to provide personal financial statements, including your credit history, income, and assets.

- Equipment Quotes: Quotes from equipment suppliers detailing the cost of the equipment you intend to purchase.

Loan Terms and Conditions

The terms and conditions of a commercial equipment loan can vary depending on the lender, your creditworthiness, and the loan amount.

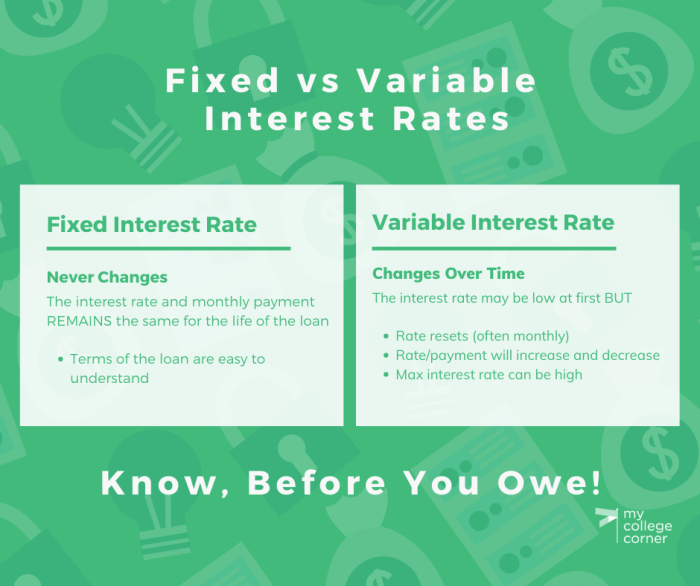

- Interest Rates: Interest rates for commercial equipment loans are typically higher than those for personal loans due to the higher risk involved. Interest rates can fluctuate based on market conditions and your credit score.

- Repayment Periods: Loan repayment periods can range from a few years to a decade, depending on the loan amount and the equipment’s lifespan.

- Collateral Requirements: As mentioned earlier, the equipment you’re financing often serves as collateral for the loan. Lenders may require additional collateral, such as real estate or other assets, to secure the loan.

- Loan Fees: Lenders may charge origination fees, closing costs, and other fees associated with the loan.

The Loan Application Process

The application process for a commercial equipment loan typically involves several steps. It’s important to understand these steps and gather all necessary documentation to ensure a smooth and successful application.

Steps Involved in Applying for a Commercial Equipment Loan

The application process for a commercial equipment loan typically involves the following steps:

- Gather your financial information: This includes your business’s financial statements, tax returns, and bank statements. This information will help the lender assess your business’s financial health and ability to repay the loan.

- Research and choose a lender: Compare different lenders and their loan terms, interest rates, and fees. Consider your specific needs and business goals when making your choice.

- Complete the loan application: This will require you to provide information about your business, the equipment you’re financing, and your intended use of the loan. Be accurate and thorough in your responses.

- Provide collateral: Most commercial equipment loans require collateral, which is an asset that the lender can claim if you default on the loan. This could include the equipment you’re financing or other business assets.

- Negotiate the loan terms: Once your application is reviewed, you may be able to negotiate the loan terms, including the interest rate, repayment period, and fees.

- Close the loan: Once you’ve agreed to the loan terms, you’ll sign the loan documents and receive the loan proceeds.

Key Factors Lenders Consider When Evaluating Loan Applications

Lenders consider several factors when evaluating loan applications, including:

- Credit history: Your business’s credit score and history are a key indicator of your creditworthiness. A strong credit history can improve your chances of loan approval and potentially secure a lower interest rate.

- Financial performance: Lenders will review your financial statements, tax returns, and bank statements to assess your business’s profitability and cash flow. A healthy financial track record demonstrates your ability to handle the loan payments.

- Business plan: A well-written business plan outlining your business goals, strategies, and financial projections can demonstrate your understanding of your business and its potential for success.

- Collateral: The value and condition of the collateral you offer can influence the lender’s decision. A strong collateral position provides the lender with additional security in case of default.

- Loan purpose: Lenders will consider the intended use of the loan. They want to ensure the equipment you’re financing aligns with your business needs and contributes to your overall growth.

Tips for Increasing the Chances of Loan Approval

There are several things you can do to improve your chances of getting your commercial equipment loan approved:

- Maintain a strong credit history: Pay your bills on time, keep your credit utilization low, and monitor your credit score regularly. A good credit history demonstrates financial responsibility.

- Improve your financial performance: Increase your business’s profitability and cash flow. This can be achieved through cost-cutting measures, increased sales, or improved efficiency.

- Develop a detailed business plan: A well-written business plan outlining your business goals, strategies, and financial projections can help you secure a loan.

- Shop around for lenders: Compare different lenders and their loan terms, interest rates, and fees to find the best option for your business.

- Prepare all necessary documentation: Gather all the required financial information, including your business’s financial statements, tax returns, and bank statements. Having this documentation readily available will streamline the application process.

Evaluating Loan Options and Choosing the Right Lender

You’ve done the groundwork, you understand commercial loans, and you know what you need to finance. Now, it’s time to shop around and find the best loan for your equipment purchase. Just like you wouldn’t buy the first car you see, you shouldn’t accept the first loan offer.

Comparing Loan Offers from Multiple Lenders

It’s crucial to compare loan offers from multiple lenders to find the best deal. This allows you to compare interest rates, fees, repayment terms, and lender reputation. This competitive approach helps ensure you’re getting the most favorable terms possible.

Factors to Consider When Evaluating Loan Options

- Interest Rate: The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. Lower interest rates mean lower overall borrowing costs. Compare APRs (Annual Percentage Rate) to get a complete picture of the interest cost, as it includes fees and other charges.

- Fees: Lenders may charge various fees, such as origination fees, closing costs, and prepayment penalties. These fees can add up, so it’s essential to factor them into your total borrowing cost.

- Repayment Terms: Repayment terms refer to the length of time you have to repay the loan. Longer repayment terms can result in lower monthly payments but may lead to higher overall interest costs. Consider your cash flow and how long it will take to generate revenue from your equipment.

- Lender Reputation: Research the lender’s reputation and track record. Look for lenders with a history of fair lending practices and customer satisfaction. Consider checking online reviews and ratings to get a sense of their reputation.

- Loan Type: There are various types of commercial equipment loans, such as term loans, lines of credit, and equipment leases. Each type has its own terms and conditions, so it’s essential to understand the differences and choose the one that best fits your needs.

Strategies for Negotiating Favorable Loan Terms

- Shop Around: Get quotes from multiple lenders to compare offers and negotiate the best terms.

- Negotiate Interest Rate: If you have a good credit score and a solid business plan, you may be able to negotiate a lower interest rate. Be prepared to provide evidence of your financial strength and the viability of your business.

- Negotiate Fees: Fees can be negotiable, so don’t be afraid to ask for lower fees or to have them waived altogether. Be prepared to explain why you deserve better terms.

- Consider Prepayment Options: Some lenders allow you to prepay your loan without penalty. This can save you money on interest if you have the funds available.

Using Commercial Loans for Equipment Financing: Case Studies

Real-world examples can illustrate how businesses have successfully utilized commercial loans to finance equipment purchases. These case studies showcase the challenges and opportunities businesses face in different industries while highlighting the benefits and outcomes achieved through commercial equipment financing.

Case Studies of Successful Equipment Financing

Understanding the success stories of businesses that have effectively used commercial loans for equipment financing provides valuable insights. These examples demonstrate the potential benefits and the real-world applications of this financing option.

- A small bakery in a bustling city secured a commercial loan to purchase a state-of-the-art oven. This investment allowed the bakery to expand its production capacity, cater to a wider customer base, and ultimately increase its revenue by 25% within a year.

- A construction company obtained a loan to acquire a new excavator, enabling them to take on larger projects. This strategic move led to a 15% increase in annual revenue and opened up new opportunities in the competitive construction industry.

- A tech startup secured a loan to purchase servers and software for their cloud-based platform. This investment allowed them to scale their operations efficiently and attract new clients, resulting in a 30% growth in user base within the first six months.

Challenges and Opportunities in Different Industries

Businesses in different industries face unique challenges and opportunities when seeking commercial equipment financing. The specific needs and circumstances of each industry shape the loan application process and the overall outcome.

- Manufacturing companies often require loans with longer terms and flexible repayment schedules to accommodate the purchase of heavy machinery or specialized equipment.

- Healthcare providers may need loans with specific features to finance medical equipment, considering the regulatory environment and the need for specialized equipment.

- Retail businesses may require loans with lower interest rates and flexible repayment terms to acquire point-of-sale systems or other equipment that supports their daily operations.

Benefits and Outcomes of Commercial Equipment Financing

Utilizing commercial loans for equipment financing offers several benefits that can significantly impact a business’s growth and profitability.

- Increased Productivity and Efficiency: Investing in new or upgraded equipment can streamline operations, boost production capacity, and enhance overall efficiency, leading to higher output and improved service delivery.

- Enhanced Competitiveness: Acquiring cutting-edge equipment can provide a competitive edge by allowing businesses to offer innovative products or services, improve quality, or deliver faster turnaround times.

- Expansion Opportunities: Equipment financing can enable businesses to expand their operations, take on new projects, or enter new markets, leading to increased revenue and market share.

- Improved Cash Flow: By spreading the cost of equipment over time through loan payments, businesses can maintain healthy cash flow and avoid tying up significant capital in upfront purchases.

Alternatives to Commercial Loans for Equipment Financing

While commercial loans are a common way to finance equipment purchases, they are not the only option. Other financing methods can be more suitable depending on your specific circumstances and the type of equipment you need.

Leasing Equipment

Leasing equipment allows you to use the equipment without owning it outright. Instead of taking out a loan to purchase the equipment, you make regular payments to the lessor over a set period. At the end of the lease term, you can return the equipment, purchase it, or renew the lease.

Advantages and Disadvantages of Leasing

Leasing offers several advantages, such as:

- Lower upfront costs: Leasing requires a smaller down payment than purchasing, making it more accessible for businesses with limited capital.

- Flexible payment options: Lease payments can be structured to fit your budget and cash flow.

- Tax benefits: Lease payments are often tax-deductible as business expenses.

- Access to newer equipment: Leasing allows you to upgrade to newer equipment more frequently.

However, leasing also has some disadvantages:

- No ownership: You don’t own the equipment at the end of the lease term.

- Potential for higher long-term costs: While the initial cost is lower, leasing can be more expensive over the long term compared to purchasing.

- Limited customization: You may have limited customization options with leased equipment.

Other Financing Options

In addition to leasing, other financing options for equipment include:

- Vendor financing: Some equipment manufacturers offer financing directly to customers. This can be a convenient option, but it may come with higher interest rates or stricter terms.

- Equipment loans from specialized lenders: Many lenders specialize in providing equipment financing. These lenders may offer more competitive rates and flexible terms than traditional banks.

- Government grants and loans: Depending on the type of equipment and your business, you may be eligible for government grants or loans.

- Crowdfunding: Crowdfunding platforms can help you raise funds from individuals or investors for your equipment purchase.

Loan Management and Repayment

Successfully managing your commercial loan repayment is crucial for maintaining a healthy financial standing and ensuring the long-term success of your business. It involves a combination of careful planning, responsible budgeting, and proactive strategies to ensure timely payments and minimize potential financial strain.

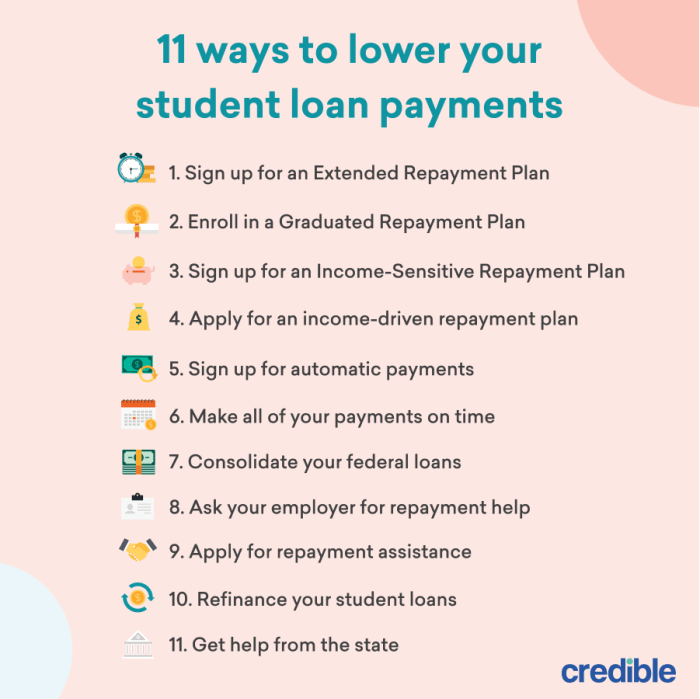

Strategies for Effective Loan Payment Management

Effective loan management involves developing strategies to ensure timely payments and minimize financial strain. Here are some key strategies:

- Budgeting and Cash Flow Management: Create a detailed budget that accurately reflects your business’s income and expenses. This will help you anticipate your monthly loan payments and ensure sufficient funds are available.

- Automated Payments: Set up automatic payments from your business bank account to the lender. This eliminates the risk of forgetting a payment and helps maintain a consistent payment history.

- Prepayment Options: Explore any prepayment options offered by your lender. Making extra payments can shorten the loan term and reduce overall interest costs.

- Communication with Lender: Maintain open communication with your lender. If you anticipate any potential difficulties in making a payment, contact them promptly to discuss options.

Maintaining a Good Credit Score and Managing Debt Responsibly

A good credit score is essential for accessing future financing and securing favorable loan terms. Managing your debt responsibly helps maintain a healthy credit score.

- Pay on Time: Make all loan payments on time, as late payments can negatively impact your credit score.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio (the amount of credit you’re using compared to your total available credit) below 30%.

- Diversify Credit: Use a mix of credit products, such as credit cards and loans, to demonstrate responsible credit management.

- Monitor Your Credit Report: Regularly review your credit report for any errors or inaccuracies that could affect your score.

Avoiding Late Payments and Potential Penalties

Late payments can lead to penalties, increased interest rates, and damage to your credit score.

- Set Payment Reminders: Use calendar reminders or mobile apps to set alerts for upcoming loan payments.

- Automatic Payment Setup: As mentioned earlier, setting up automatic payments can eliminate the risk of forgetting a payment.

- Plan for Unexpected Expenses: Have a contingency plan in place to handle unexpected expenses that could impact your ability to make loan payments.

- Communicate with Lender: If you anticipate a potential difficulty making a payment, contact your lender immediately to discuss options.

Understanding Different Loan Types

It can be overwhelming to navigate the various loan options available, especially when it comes to financing equipment for your business. Each loan type has unique characteristics, making it essential to understand the differences to make an informed decision. This section will provide a comprehensive comparison of common loan types, highlighting their key features, benefits, and drawbacks.

Comparing Loan Types

Understanding the differences between various loan types is crucial for choosing the best option for your equipment financing needs. This table compares and contrasts personal loans, unsecured loans, commercial loans, student loans, and equipment loans across key factors:

| Loan Type | Loan Purpose | Interest Rates | Repayment Terms | Collateral Requirements | Eligibility Criteria |

|---|---|---|---|---|---|

| Personal Loan | Debt consolidation, home improvement, medical expenses, travel, and other personal needs | Variable, typically higher than secured loans | 12-84 months | None | Good credit score, steady income, debt-to-income ratio (DTI) below 50% |

| Unsecured Loan | Business expenses, working capital, debt consolidation, and other business needs | Variable, typically higher than secured loans | 12-72 months | None | Good credit score, strong business financials, established business history |

| Commercial Loan | Equipment financing, real estate, working capital, and other business needs | Variable, typically lower than unsecured loans | 12-25 years | May require collateral, depending on the loan type | Good credit score, strong business financials, established business history, collateral (if required) |

| Student Loan | Tuition, fees, living expenses, and other education-related costs | Fixed or variable, typically lower than other loan types | 10-30 years | None | Enrolled in an eligible educational program, US citizenship or permanent residency, and meet other eligibility criteria |

| Equipment Loan | Financing specific equipment, such as machinery, vehicles, and technology | Variable, typically lower than unsecured loans | 12-84 months | May require the financed equipment as collateral | Good credit score, strong business financials, established business history, and the equipment being financed |

Utilizing commercial loans for equipment financing can be a strategic move for businesses seeking to upgrade their operations and achieve their growth objectives. By carefully evaluating loan options, managing loan payments responsibly, and exploring alternative financing avenues, businesses can leverage the power of commercial loans to acquire the equipment they need to succeed. Remember, thorough research, careful planning, and proactive loan management are essential for maximizing the benefits of commercial equipment financing.

Common Queries

What are the typical interest rates for commercial equipment loans?

Interest rates for commercial equipment loans vary depending on factors like the borrower’s credit score, loan amount, and loan term. Rates can range from 5% to 15% or more.

What are the common collateral requirements for commercial equipment loans?

Lenders often require collateral for commercial equipment loans, which can include the equipment itself, other assets, or personal guarantees. The specific collateral requirements depend on the lender and the loan amount.

How long does it take to get approved for a commercial equipment loan?

The approval process for a commercial equipment loan can take anywhere from a few days to several weeks, depending on the lender and the complexity of the loan application.