Securing a personal loan can be a great way to achieve your financial goals, but navigating the complex world of fees can feel overwhelming. Understanding the different types of fees associated with personal loans and implementing strategies to minimize them is crucial for ensuring you get the best possible deal.

This guide will equip you with the knowledge and tools to navigate the world of personal loans, helping you avoid hidden costs and make informed decisions that protect your financial well-being.

Choosing a Loan with Lower Fees

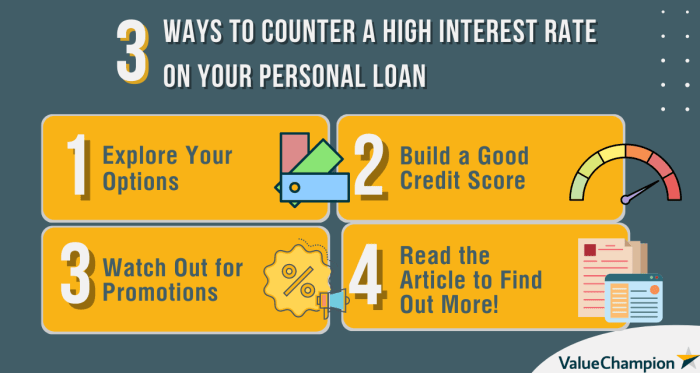

Once you’ve established good credit and determined how much you need to borrow, you can start shopping for a personal loan. The key to getting the best deal is comparing offers from multiple lenders.This involves looking at more than just the interest rate. You need to factor in all the fees associated with the loan, as these can significantly impact the overall cost.

Comparing Interest Rates and Fees

It’s crucial to compare interest rates and fees from different lenders to find the most affordable option. Look for lenders that offer transparent and competitive terms.

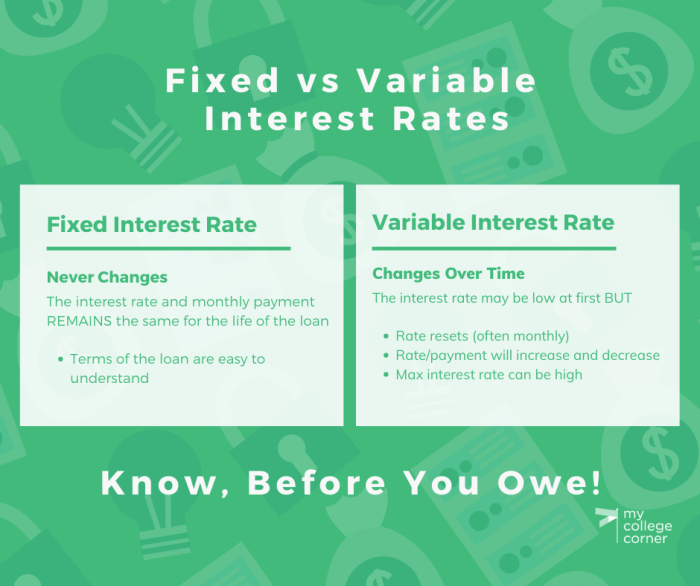

- Interest rates: These are the percentage charged on the amount borrowed, expressed as an annual percentage rate (APR). Lower APRs translate to lower interest payments over the loan term.

- Origination fees: These are one-time fees charged by the lender for processing the loan application. They’re typically a percentage of the loan amount.

- Application fees: Some lenders charge a fee for submitting a loan application, even if it’s not approved.

- Prepayment penalties: These are fees charged if you pay off the loan early. They’re not common, but it’s important to check for them.

- Late payment fees: These are penalties charged if you miss a payment. They can be significant, so it’s important to make payments on time.

Using Online Lenders and Credit Unions

Online lenders and credit unions often offer lower fees and more competitive interest rates than traditional banks. They often have lower overhead costs, which they can pass on to borrowers in the form of lower fees.

- Online lenders: These are financial institutions that operate solely online. They typically have streamlined operations and lower overhead costs, which can translate to lower fees for borrowers.

- Credit unions: These are member-owned financial institutions that often offer lower rates and fees than banks. They’re not-for-profit organizations, so they’re focused on serving their members rather than maximizing profits.

Reading the Loan Agreement Carefully

Before signing any loan agreement, read it carefully and make sure you understand all the terms and conditions. This includes the interest rate, fees, repayment schedule, and any other relevant information.

Don’t be afraid to ask questions if you don’t understand something. It’s better to be safe than sorry.

Negotiating Lower Fees

Negotiating lower fees on a personal loan can save you significant money in the long run. While lenders are often hesitant to negotiate, there are ways to increase your chances of success.

Leveraging Your Creditworthiness

A strong credit score and a history of responsible borrowing are your strongest negotiating tools. When you demonstrate financial responsibility, lenders are more likely to consider your request for lower fees.

- A high credit score indicates a lower risk for the lender, making them more willing to negotiate.

- A history of on-time payments and responsible credit use shows lenders that you are a reliable borrower.

Negotiating Specific Fees

You can try negotiating specific fees, such as the origination fee. This fee is charged by the lender to cover the administrative costs of processing your loan.

- You can request a lower origination fee or even try to have it waived entirely, especially if you have a strong credit score and are willing to accept a higher interest rate.

- Other fees, such as late payment fees or prepayment penalties, may also be negotiable.

Effective Communication Strategies

When negotiating fees, it is important to be polite, professional, and assertive.

- Start by thanking the lender for their time and consideration.

- Clearly state your request for a lower fee and explain why you believe you deserve it, highlighting your strong credit score and responsible borrowing history.

- Be prepared to negotiate and compromise, but don’t be afraid to walk away if the lender is unwilling to meet your needs.

“I understand that you have an origination fee, but I have an excellent credit score and a history of on-time payments. Would you be willing to consider a lower fee or waive it entirely in exchange for a slightly higher interest rate?”

Avoiding Late Payment Fees

Late payment fees are a common problem for borrowers. These fees can add up quickly, making your loan more expensive and harming your credit score. To avoid late payment fees, it’s crucial to make your payments on time.

Setting Up Automatic Payments or Reminders

To ensure timely payments, consider setting up automatic payments or reminders. Automatic payments withdraw the payment amount from your bank account on the due date, eliminating the risk of forgetting. Reminders can be set up through your lender’s online portal, mobile app, or by using a third-party service.

Table of Late Payment Fees

Here’s a table illustrating typical late payment fees:

| Fee Type | Description | Average Fee | How to Avoid |

|---|---|---|---|

| Late Payment Fee | Charged for payments received after the due date. | $25-$35 | Make payments on time or set up automatic payments. |

| Returned Payment Fee | Charged when a payment is returned due to insufficient funds. | $25-$35 | Ensure sufficient funds in your account before the due date. |

Comparing Loan Types

Choosing the right loan type can significantly impact the overall cost of borrowing, including fees. Understanding the fees associated with different loan types and their advantages and disadvantages is crucial in making informed decisions.

Average Fees Associated with Different Loan Types

The following table provides a general overview of the average fees associated with different loan types. Keep in mind that actual fees can vary depending on the lender, loan amount, credit score, and other factors.

| Loan Type | Origination Fee | Application Fee | Prepayment Penalty | Late Payment Fee |

|---|---|---|---|---|

| Personal Loan | 1-5% of the loan amount | $0-$50 | May apply | $25-$50 |

| Unsecured Loan | 1-6% of the loan amount | $0-$75 | May apply | $25-$50 |

| Commercial Loan | 0.5-2% of the loan amount | $100-$500 | May apply | $50-$100 |

| Student Loan | 0-1% of the loan amount | $0-$50 | May apply | $25-$50 |

Advantages and Disadvantages of Different Loan Types

- Personal Loans:

- Advantages: Personal loans typically have lower interest rates than credit cards and can be used for a variety of purposes, such as debt consolidation, home improvements, or medical expenses.

- Disadvantages: While personal loans offer flexibility, they often come with origination fees, which can add to the overall cost of borrowing. They also may have prepayment penalties, making it more expensive to pay off the loan early.

- Unsecured Loans:

- Advantages: Unsecured loans, like personal loans, are not backed by collateral, offering flexibility in use. They can be a good option for individuals with good credit history, as they often have lower interest rates than secured loans.

- Disadvantages: Unsecured loans usually come with higher interest rates than secured loans, and they may have higher origination fees. They also carry the risk of a higher late payment fee.

- Commercial Loans:

- Advantages: Commercial loans are designed for businesses and often offer larger loan amounts with longer repayment terms. They can be used for various purposes, such as equipment financing, working capital, or real estate acquisition.

- Disadvantages: Commercial loans usually involve higher interest rates and origination fees than personal loans. They also often require a strong business plan and good credit history.

- Student Loans:

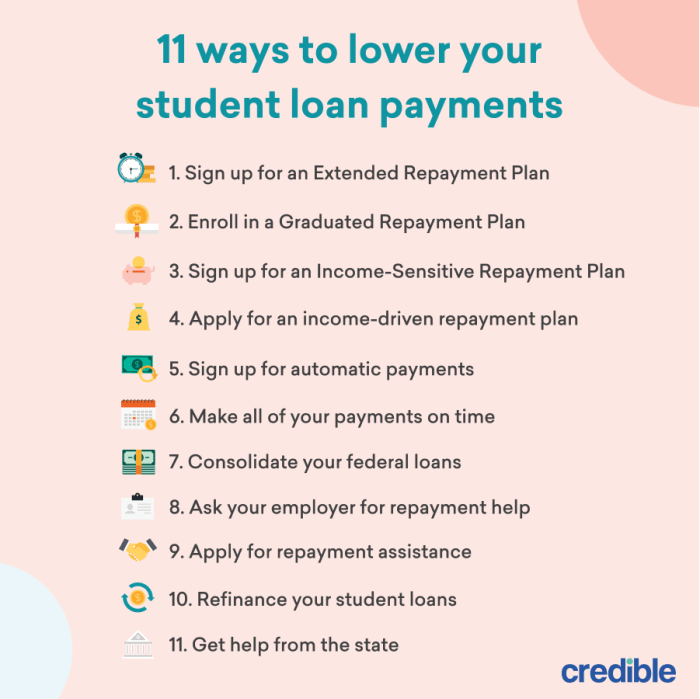

- Advantages: Student loans are specifically designed to finance education costs. They offer flexible repayment options, including income-driven repayment plans, and are often subsidized, meaning the government pays the interest while you are in school.

- Disadvantages: Student loans can accumulate significant interest over time, especially if you choose a variable interest rate. They can also be difficult to discharge through bankruptcy.

Situations Where Each Loan Type Might Be the Most Appropriate Choice

- Personal Loans: Ideal for debt consolidation, home improvements, medical expenses, or any other personal expenses that require a lump sum of money.

- Unsecured Loans: Suitable for individuals with good credit who need a loan quickly and don’t have collateral to offer.

- Commercial Loans: Best for businesses that need funding for various purposes, such as equipment financing, working capital, or real estate acquisition.

- Student Loans: The most appropriate choice for financing education costs, offering flexible repayment options and potential interest subsidies.

Responsible Borrowing Practices

Responsible borrowing practices are essential for minimizing the risk of incurring high fees and managing your finances effectively. By adopting these practices, you can ensure that you’re borrowing responsibly and avoid potential financial strain.

Building a Strong Credit Score

A strong credit score is crucial for obtaining favorable loan terms and avoiding high fees. A higher credit score signifies to lenders that you’re a responsible borrower, making them more likely to offer you lower interest rates and better loan conditions. Here are some tips for building a strong credit score:

- Pay your bills on time: Timely payments are the most significant factor influencing your credit score. Make sure to set reminders and automate payments to avoid missing deadlines.

- Keep your credit utilization low: Your credit utilization ratio is the amount of credit you’re using compared to your total available credit. Aim to keep this ratio below 30% to maintain a healthy credit score.

- Avoid opening too many new accounts: Each time you apply for a new credit card or loan, a hard inquiry is placed on your credit report, which can temporarily lower your score. Only apply for credit when necessary.

- Monitor your credit report regularly: Check your credit report at least once a year for any errors or fraudulent activity. You can obtain free copies from the three major credit bureaus: Experian, Equifax, and TransUnion.

Maintaining a Healthy Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is the percentage of your gross monthly income that goes towards debt payments. Lenders use this ratio to assess your ability to repay a loan. A lower DTI generally indicates a lower risk to lenders, leading to better loan terms.

The formula for calculating your DTI is: (Total monthly debt payments / Gross monthly income) x 100

- Reduce unnecessary expenses: Identify areas where you can cut back on spending and allocate those savings towards paying down debt.

- Increase your income: Consider taking on a side hustle or seeking a raise to boost your income and lower your DTI.

- Prioritize high-interest debt: Focus on paying down debts with the highest interest rates first to minimize the overall cost of borrowing.

Creating a Budget and Tracking Expenses

A budget is a roadmap for your finances, helping you track your income and expenses and make informed decisions about your spending. By creating a budget and monitoring your expenses, you can avoid overspending and potential late payments on your loans.

- Track your income and expenses: Use a budgeting app, spreadsheet, or notebook to record all your income and expenses for a month.

- Categorize your expenses: Group your expenses into categories like housing, transportation, food, and entertainment to identify areas where you can save.

- Set realistic financial goals: Establish short-term and long-term financial goals, such as paying off debt or saving for a down payment on a house.

- Review your budget regularly: Make adjustments to your budget as needed based on changes in your income, expenses, or financial goals.

By understanding the intricacies of personal loan fees, employing smart strategies for comparison and negotiation, and embracing responsible borrowing practices, you can effectively minimize the impact of fees and secure a loan that aligns with your financial goals. Remember, knowledge is power, and armed with the right information, you can navigate the personal loan landscape with confidence.

FAQ Compilation

What are the most common types of personal loan fees?

Origination fees, application fees, late payment fees, and prepayment penalties are some of the most common fees associated with personal loans.

How can I improve my chances of getting a lower interest rate on a personal loan?

Maintaining a good credit score, having a low debt-to-income ratio, and demonstrating a history of responsible borrowing can significantly improve your chances of securing a lower interest rate.

Is it possible to negotiate a lower origination fee?

Yes, you can sometimes negotiate a lower origination fee by highlighting your strong creditworthiness and financial history. Be prepared to present your case effectively and be open to exploring alternative options.