Planning a dream vacation often involves financial considerations, and a personal loan can be a helpful tool to bridge the gap between your travel aspirations and your current savings. While taking out a loan for vacation expenses might seem unconventional, it can be a viable option if managed responsibly. This guide explores the ins and outs of using a personal loan for your next adventure, offering insights into choosing the right loan, planning your budget, and navigating repayment strategies.

The key is to approach this financial decision with a well-defined plan. Understanding the pros and cons, comparing different loan options, and carefully budgeting your expenses are crucial steps to ensure that your vacation doesn’t turn into a financial burden. We’ll delve into these aspects and provide practical advice to help you make informed decisions about using a personal loan for your travel plans.

Choosing the Right Personal Loan

Once you’ve decided to use a personal loan for your vacation expenses, the next step is to find the right loan for your needs. There are many different types of personal loans available, each with its own set of features, interest rates, and repayment options. Choosing the right loan can save you money in the long run.

Types of Personal Loans

Personal loans come in different forms, each tailored to specific needs and situations. Understanding these differences is crucial for making an informed decision.

- Unsecured Personal Loans: These are the most common type of personal loan. They are not secured by any collateral, meaning the lender is taking a greater risk. As a result, unsecured personal loans typically have higher interest rates than secured loans.

- Secured Personal Loans: These loans are backed by collateral, such as a car or a house. If you default on the loan, the lender can seize the collateral to recover their losses. Secured personal loans typically have lower interest rates than unsecured loans because the lender is taking less risk.

- Peer-to-Peer (P2P) Loans: These loans are made through online platforms that connect borrowers with individual investors. P2P loans can offer competitive interest rates, but they may be more difficult to qualify for than traditional personal loans.

- Home Equity Loans: These loans are secured by your home’s equity, which is the difference between your home’s value and the amount you owe on your mortgage. Home equity loans typically have lower interest rates than unsecured personal loans, but you risk losing your home if you default on the loan.

Interest Rates and Loan Terms

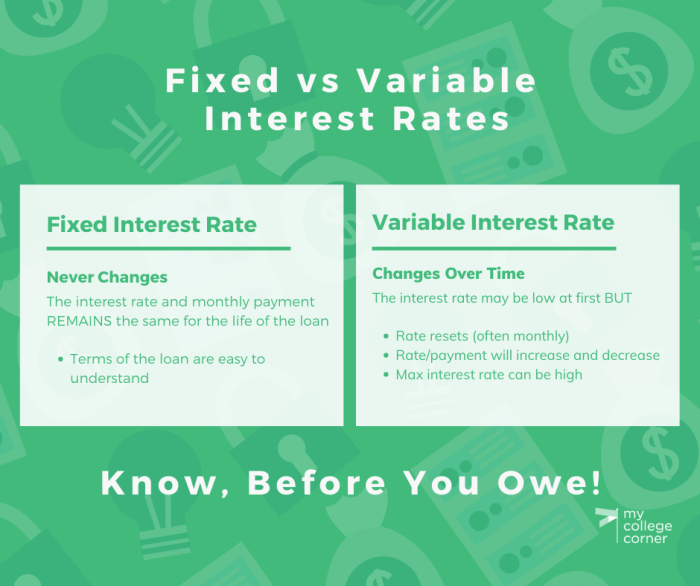

Interest rates and loan terms are two key factors to consider when choosing a personal loan.

- Interest Rate: The interest rate is the cost of borrowing money. It is expressed as a percentage of the loan amount. The lower the interest rate, the less you will pay in interest over the life of the loan.

- Loan Term: The loan term is the length of time you have to repay the loan. The longer the loan term, the lower your monthly payments will be, but you will pay more in interest over the life of the loan.

Repayment Options

Most personal loans offer a variety of repayment options, such as fixed monthly payments or a balloon payment at the end of the loan term.

- Fixed Monthly Payments: With fixed monthly payments, you make the same amount each month until the loan is paid off.

- Balloon Payment: With a balloon payment, you make smaller monthly payments for a set period of time, followed by a larger lump sum payment at the end of the loan term.

Tips for Finding the Best Personal Loan

Here are some tips for finding the best personal loan for your vacation expenses:

- Shop Around: Compare interest rates and loan terms from multiple lenders before you choose a loan.

- Check Your Credit Score: Your credit score will play a major role in determining the interest rate you qualify for. The higher your credit score, the lower your interest rate will be.

- Consider Loan Fees: Some lenders charge origination fees or other fees associated with personal loans. Make sure you factor these fees into your overall cost of borrowing.

- Read the Fine Print: Carefully review the loan agreement before you sign it. Make sure you understand the terms and conditions of the loan, including the interest rate, loan term, and repayment options.

Planning Your Vacation Expenses

Planning your vacation expenses effectively is crucial for a stress-free and enjoyable trip. A well-structured budget will ensure you can afford all your desired activities and experiences without overspending.

Designing a Detailed Vacation Budget

A detailed budget is essential for managing your vacation finances. It helps you allocate funds for different expenses and track your spending. Here’s how to create a comprehensive budget:

- Identify Your Travel Destination and Dates: Determine your travel destination and dates to get a clear picture of the duration of your trip. This information will help you estimate the costs involved.

- List All Potential Expenses: Make a comprehensive list of all potential expenses you might encounter during your vacation. This includes:

- Flights and transportation

- Accommodation

- Food and drinks

- Activities and attractions

- Souvenirs and shopping

- Emergency funds

- Research and Estimate Costs: Research the estimated costs for each expense category based on your destination and travel dates. You can use online travel websites, travel blogs, and forums for this purpose.

- Factor in Unexpected Expenses: It’s wise to include a buffer for unexpected expenses. These could include unforeseen travel delays, medical emergencies, or additional activities you might decide to do during your trip.

- Use a Budget Spreadsheet or App: Utilize a budget spreadsheet or app to track your expenses. This will help you stay organized and monitor your spending against your allocated budget.

Creating a Breakdown of Expenses by Category

Breaking down your vacation expenses by category allows you to prioritize spending and identify areas where you might need to adjust your budget. Here’s a breakdown of common vacation expense categories:

- Flights and Transportation: This includes round-trip airfare, airport transfers, and local transportation within your destination.

- Accommodation: This covers the cost of your hotel, Airbnb, or other lodging options. Consider factors like location, amenities, and reviews when choosing your accommodation.

- Food and Drinks: Allocate funds for meals, snacks, and beverages. Research the cost of dining in your destination and factor in whether you plan to cook some meals yourself.

- Activities and Attractions: This category includes entrance fees for museums, theme parks, and other attractions, as well as costs for tours, excursions, and entertainment.

- Souvenirs and Shopping: Set a budget for souvenirs, gifts, and any shopping you plan to do during your trip. This will help you avoid overspending on non-essential items.

- Emergency Funds: It’s essential to have a separate emergency fund for unexpected events. This could cover medical expenses, lost luggage, or travel disruptions.

Organizing Your Travel Plans and Itinerary

A well-organized itinerary is crucial for maximizing your time and ensuring a smooth travel experience. Here are some steps to create a comprehensive itinerary:

- Plan Your Daily Activities: Artikel your planned activities for each day of your trip. This will help you allocate time efficiently and avoid rushing.

- Book Transportation and Accommodation: Reserve your flights, accommodation, and any necessary transportation in advance, especially during peak travel seasons.

- Purchase Tickets for Attractions: Book tickets for popular attractions or tours ahead of time to secure your spot and avoid waiting in long lines.

- Research Local Transportation Options: Familiarize yourself with the local transportation system in your destination. This could include public buses, trains, taxis, or ride-sharing services.

- Create a Packing List: Make a detailed packing list to ensure you have everything you need for your trip without overpacking. This will also help you stay organized and avoid unnecessary baggage fees.

Alternatives to Personal Loans for Vacation Expenses

While personal loans can be a viable option for funding your vacation, they come with interest charges and repayment terms that may not be ideal for everyone. Fortunately, several alternatives exist that might be more suitable depending on your financial situation and travel plans.

Travel Credit Cards

Travel credit cards are designed specifically for travelers and offer a range of benefits that can help you save money and manage your expenses effectively.

- Reward Points and Miles: Many travel credit cards offer generous reward programs that allow you to earn points or miles on your purchases, which can be redeemed for flights, hotels, and other travel-related expenses. This can significantly reduce the overall cost of your trip.

- Travel Insurance: Some travel credit cards include travel insurance coverage, such as trip cancellation insurance, medical insurance, and baggage protection. This can provide peace of mind and protect you against unexpected events that could disrupt your vacation.

- Travel Perks: Travel credit cards often offer exclusive travel benefits, such as airport lounge access, priority boarding, and discounts on rental cars.

- 0% Intro APR: Some travel credit cards offer a 0% introductory annual percentage rate (APR) for a certain period. This allows you to make purchases without accruing interest, giving you more time to pay off your balance.

However, travel credit cards also have some drawbacks.

- High APRs: If you don’t pay off your balance in full each month, you’ll be charged interest at a high APR, which can quickly add up.

- Annual Fees: Some travel credit cards have annual fees, which can add to the overall cost.

- Credit Score Impact: If you don’t manage your credit card responsibly, it can negatively impact your credit score.

Travel Loans

Travel loans are specifically designed for financing travel expenses and often come with lower interest rates than personal loans.

- Lower Interest Rates: Travel loans typically have lower interest rates than personal loans, making them a more affordable option for financing your trip.

- Flexible Repayment Terms: Travel loans often offer flexible repayment terms, allowing you to choose a repayment schedule that fits your budget.

- Dedicated Funds: Travel loans are specifically for travel expenses, making it easier to track your spending and ensure that the money is used for its intended purpose.

However, travel loans may not be the best option for everyone.

- Limited Availability: Travel loans may not be available from all lenders, and the eligibility criteria can be stricter than for personal loans.

- Potential for Higher Interest Rates: While travel loans generally have lower interest rates than personal loans, they can still be higher than other financing options, such as credit cards.

Savings Plans

Saving for your vacation is the most straightforward and affordable way to finance your trip.

- Interest Earnings: Savings accounts allow you to earn interest on your deposits, helping your money grow over time.

- No Interest Charges: Saving for your vacation eliminates the need to borrow money and pay interest charges.

- Financial Discipline: Saving for your vacation encourages financial discipline and helps you avoid overspending.

However, saving for a vacation takes time and requires consistent effort.

- Time Commitment: Saving for a vacation can take several months or even years, depending on the cost of your trip and your savings rate.

- Potential for Missed Opportunities: If you save for a long time, you may miss out on opportunities to travel sooner.

Financial Literacy for Vacation Planning

Taking a vacation can be an exciting and rewarding experience, but it’s crucial to approach it with financial responsibility. Financial literacy plays a vital role in ensuring your vacation is enjoyable without putting your financial stability at risk. This section delves into the key concepts of financial literacy that are relevant to planning a successful vacation.

Budgeting

Budgeting is the cornerstone of responsible vacation planning. It involves creating a detailed plan that Artikels your estimated expenses and income. A well-structured budget helps you determine how much you can realistically afford to spend on your trip, ensuring you don’t overspend and leave yourself in a precarious financial position.

Creating a Vacation Budget

- Identify your income: Determine your monthly income and any additional sources of revenue, such as side hustles or investments.

- List your expenses: Make a comprehensive list of all your recurring expenses, including rent, utilities, groceries, transportation, and debt payments.

- Allocate funds for your vacation: Decide on a realistic vacation budget based on your income and expenses. Consider factors like destination, travel dates, accommodation, activities, and transportation costs.

- Track your spending: Monitor your spending throughout your trip to ensure you stay within your budget. This helps prevent unexpected financial surprises and allows you to adjust your spending habits if necessary.

Saving

Saving is essential for funding your vacation. By setting aside a portion of your income regularly, you can accumulate the necessary funds to cover your travel expenses without relying solely on debt.

Saving Strategies

- Set a savings goal: Define a specific amount you need to save for your vacation. This gives you a clear target to work towards and motivates you to save consistently.

- Automate your savings: Set up automatic transfers from your checking account to your savings account. This ensures regular savings contributions without requiring you to manually transfer funds.

- Find ways to cut expenses: Identify areas where you can reduce your spending, such as eating out less frequently or finding cheaper entertainment options.

- Explore high-yield savings accounts: Consider opening a high-yield savings account to maximize your interest earnings.

Responsible Borrowing

While borrowing can be a tempting option to fund a vacation, it’s crucial to do so responsibly.

Borrowing Responsibly

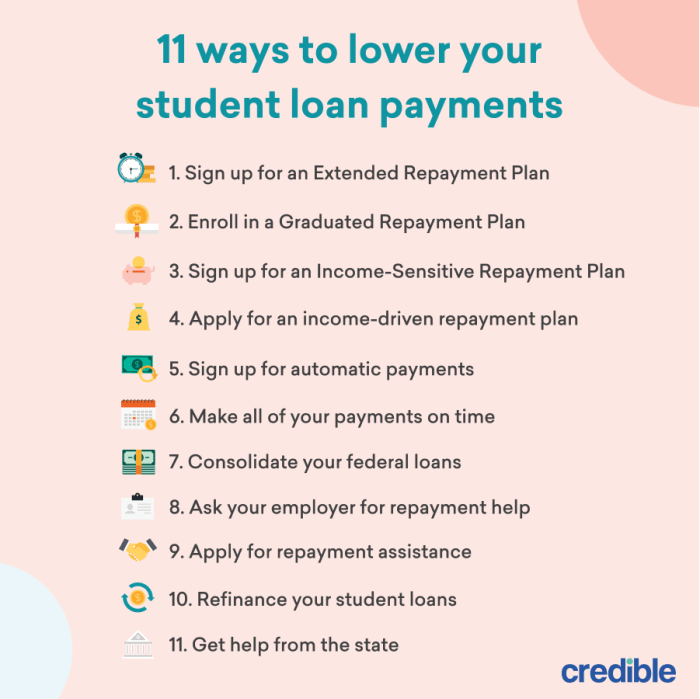

- Explore all financing options: Compare different loan options, such as personal loans, travel credit cards, and vacation financing plans.

- Calculate the total cost of borrowing: Consider the interest rates, fees, and repayment terms associated with each loan option.

- Only borrow what you can afford to repay: Ensure you can comfortably manage your monthly payments without straining your budget.

- Prioritize paying off debt: Make timely payments on your loan to avoid accumulating high interest charges and damaging your credit score.

Ultimately, deciding whether a personal loan is the right fit for your vacation expenses depends on your individual financial situation and travel goals. By carefully weighing your options, comparing loan terms, and adhering to a responsible repayment plan, you can make informed decisions that allow you to enjoy your dream vacation without jeopardizing your future financial well-being. Remember, financial literacy is key to successful travel planning, and understanding the nuances of personal loans empowers you to make smart choices that align with your travel aspirations.

Answers to Common Questions

What are the potential downsides of using a personal loan for vacation expenses?

The primary downside is accumulating debt. If you’re not careful with your repayment plan, it can lead to higher interest charges and affect your credit score. Additionally, if you’re not able to make timely payments, it can impact your ability to secure future loans.

Is it better to use a personal loan or a travel credit card for vacation expenses?

The best option depends on your financial situation and spending habits. A travel credit card can offer rewards and travel insurance, but you need to be disciplined with payments to avoid accruing high interest charges. A personal loan provides a fixed interest rate and repayment schedule, making it more predictable, but you won’t have the same rewards or benefits.

How can I manage my loan repayments while on vacation?

It’s essential to set up automatic payments or reminders to ensure timely repayments. You can also create a travel budget that includes a dedicated amount for loan repayments. This will help you stay on track and avoid late fees or penalties.