Navigating the world of unsecured loans can feel overwhelming, especially when you need quick access to funds. Fortunately, several online lenders offer streamlined processes and fast approvals, making it easier to secure the financial assistance you need. This guide explores the top online lenders for unsecured loans with quick approval, helping you understand the factors that influence approval speed and make informed decisions about your borrowing needs.

From understanding the basics of unsecured loans and quick approval to comparing loan terms and features, we cover everything you need to know. We’ll also delve into strategies for improving your credit score and presenting a strong loan application, maximizing your chances of securing a loan quickly.

Factors Influencing Quick Loan Approval

Getting approved for an unsecured loan quickly depends on various factors that lenders carefully consider. While some factors are more crucial than others, all play a role in determining the likelihood of a fast approval.

Credit Score and Credit History

A strong credit score is the foundation of quick loan approval. Lenders rely heavily on your credit history to assess your creditworthiness and risk.

A higher credit score indicates a responsible borrower with a history of repaying debts on time.

A good credit score makes lenders more confident in your ability to manage the loan responsibly.

- Your credit score reflects your past borrowing behavior and ability to repay debts.

- A higher credit score translates to lower interest rates and more favorable loan terms.

- A low credit score may result in loan denial or higher interest rates, making it more expensive to borrow.

Income, Debt-to-Income Ratio, and Employment History

Lenders assess your ability to repay the loan by evaluating your income, debt-to-income ratio, and employment history.

- A stable income source provides reassurance to lenders that you can afford the monthly loan payments.

- The debt-to-income ratio, calculated by dividing your monthly debt payments by your gross monthly income, reveals how much of your income is already committed to debt obligations. A lower debt-to-income ratio signifies greater financial stability.

- A consistent employment history demonstrates your ability to maintain a steady income stream, making you a more reliable borrower.

Top Online Lenders for Unsecured Loans

Choosing the right online lender for an unsecured loan can be overwhelming, given the abundance of options available. This section will highlight some of the top online lenders, providing a comprehensive overview of their strengths, weaknesses, and eligibility criteria.

Top Online Lenders for Unsecured Loans

Finding a reliable online lender for an unsecured loan requires careful consideration of factors like interest rates, loan amounts, and eligibility criteria. Here’s a table outlining some of the top online lenders, their loan amounts, interest rates, and APRs:

| Lender Name | Loan Amount | Interest Rate | APR |

|---|---|---|---|

| LendingClub | $1,000 – $40,000 | 6.95% – 35.99% | 7.04% – 35.99% |

| Upstart | $1,000 – $50,000 | 5.99% – 35.99% | 6.24% – 35.99% |

| SoFi | $5,000 – $100,000 | 5.99% – 19.99% | 6.24% – 20.99% |

| LightStream | $5,000 – $100,000 | 4.99% – 19.99% | 5.24% – 20.99% |

LendingClub:

Strengths

Known for its user-friendly platform, transparent pricing, and diverse loan options.

Weaknesses

May have higher interest rates compared to some competitors.

Eligibility Criteria

Good credit score (at least 660), steady income, and responsible credit history. Upstart:

Strengths

Utilizes alternative data points beyond credit scores to assess creditworthiness, making it a good option for those with limited credit history.

Weaknesses

Limited loan amounts compared to some other lenders.

Eligibility Criteria

Minimum credit score of 620, stable income, and a minimum age of 18. SoFi:

Strengths

Offers competitive interest rates and a wide range of loan products, including personal loans, student loans, and mortgages.

Weaknesses

May have higher origination fees compared to other lenders.

Eligibility Criteria

Good credit score (at least 680), consistent income, and a minimum age of 18. LightStream:

Strengths

Offers some of the lowest interest rates in the market, with no origination fees.

Weaknesses

Requires a strong credit score to qualify.

Eligibility Criteria

Excellent credit score (at least 700), consistent income, and a minimum age of 18.

Comparing Loan Terms and Features

When evaluating online lenders for unsecured loans, it’s crucial to compare the loan terms and features offered. This helps ensure you get the best possible deal and understand the loan’s implications.

Loan Amounts, Interest Rates, and Repayment Terms

Understanding the loan amounts, interest rates, and repayment terms offered by different lenders is essential for making an informed decision. These factors directly impact the overall cost of the loan and your monthly payments.

- Loan Amounts: Online lenders typically offer unsecured loans ranging from a few hundred dollars to tens of thousands. The specific loan amount you qualify for will depend on your creditworthiness, income, and debt-to-income ratio.

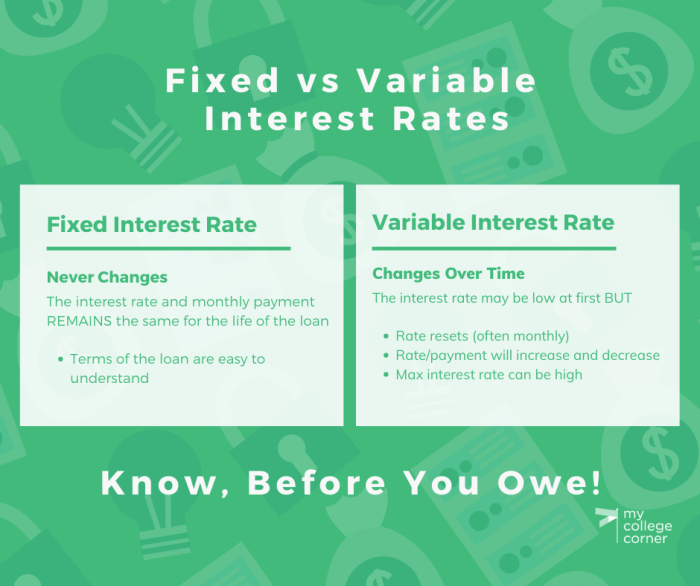

- Interest Rates: Interest rates on unsecured loans can vary widely depending on your credit score, loan amount, and lender. Lenders typically offer lower rates to borrowers with good credit.

- Repayment Terms: Repayment terms, or the duration of the loan, also impact the overall cost. Shorter repayment terms generally result in higher monthly payments but lower overall interest charges. Longer terms may have lower monthly payments but lead to higher overall interest costs.

Fees

Online lenders often charge various fees associated with unsecured loans. These fees can add to the overall cost of borrowing and should be considered when comparing lenders.

- Origination Fees: This is a one-time fee charged by lenders to cover the cost of processing your loan application. Origination fees are typically a percentage of the loan amount.

- Late Payment Fees: These fees are charged if you miss a loan payment. Late payment fees can range from a few dollars to a percentage of the missed payment.

- Prepayment Penalties: Some lenders charge a prepayment penalty if you pay off your loan early. This penalty can discourage borrowers from paying down their debt faster and can add to the overall cost.

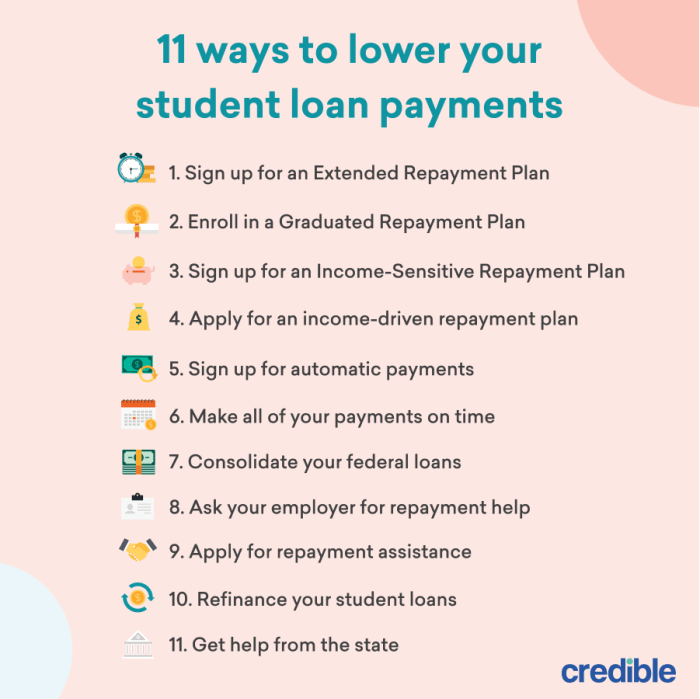

Flexible Repayment Options

Some online lenders offer flexible repayment options that can help borrowers manage their debt and avoid late payments.

- Skip-a-Payment: This option allows borrowers to temporarily skip a payment, providing financial flexibility in times of unexpected expenses or financial hardship.

- Hardship Programs: These programs offer temporary assistance to borrowers facing financial difficulties. Hardship programs may include reduced monthly payments, extended repayment terms, or a temporary suspension of payments.

Unique Features and Benefits

Certain online lenders offer unique features or benefits that may be appealing to specific borrowers.

- Autopay Discounts: Some lenders offer discounts on interest rates for borrowers who enroll in automatic payments.

- Loan Consolidation: This feature allows borrowers to combine multiple debts into a single loan with a lower interest rate. This can simplify debt management and potentially reduce monthly payments.

- Early Repayment Incentives: Some lenders offer incentives for borrowers who pay off their loans early. This can encourage borrowers to pay down their debt faster and save on interest charges.

Tips for Securing Quick Loan Approval

Getting quick approval for an unsecured loan requires a combination of good financial habits and strategic preparation. By understanding the factors that lenders consider and taking proactive steps to improve your creditworthiness, you can significantly increase your chances of securing a loan quickly.

Improving Credit Score and Credit History

A strong credit score is the cornerstone of a successful loan application. Lenders use your credit score to assess your creditworthiness and determine the risk associated with lending you money. Here’s how you can improve your credit score:

- Pay your bills on time: This is the most important factor in building a good credit score. Late payments negatively impact your score, so make sure to pay all your bills, including credit cards, loans, and utilities, on time.

- Keep your credit utilization low: Credit utilization refers to the amount of credit you’re using compared to your available credit limit. Aim to keep your credit utilization ratio below 30%.

- Avoid opening too many new credit accounts: Every time you apply for a new credit account, a hard inquiry is made on your credit report, which can temporarily lower your score. Limit your applications to only those you truly need.

- Check your credit report for errors: Mistakes on your credit report can negatively affect your score. Review your credit report regularly and dispute any inaccuracies.

Gathering Necessary Documentation and Presenting a Strong Application

Once you’ve taken steps to improve your credit score, you need to gather the necessary documentation and present a strong application. Here’s what lenders typically require:

- Proof of income: Lenders need to verify your ability to repay the loan. Provide recent pay stubs, tax returns, or bank statements to demonstrate your income.

- Personal identification: A valid driver’s license or passport is usually required.

- Proof of residence: Lenders may request a recent utility bill or bank statement showing your address.

- Credit history: Provide your Social Security number so the lender can pull your credit report.

- Financial information: Be prepared to provide details about your assets, debts, and other financial obligations.

Presenting a Strong Application

To make your application stand out, consider the following:

- Be transparent and accurate: Provide complete and accurate information on your application. Any inconsistencies or omissions can raise red flags and delay the approval process.

- Explain any credit challenges: If you have any negative marks on your credit report, provide a clear explanation. Lenders understand that life happens, and being transparent about your financial history can show your willingness to take responsibility.

- Highlight your positive financial attributes: If you have a history of responsible borrowing or other positive financial habits, emphasize these aspects in your application.

- Follow up with the lender: After submitting your application, follow up with the lender to check on its status. This shows your interest in the loan and your commitment to the process.

Related Loan Types

Understanding the various loan types available can help you choose the right one for your needs. While unsecured loans are a popular choice for individuals, several other loan types cater to different financial situations and purposes. Here’s a brief overview of some common loan types.

Personal Loans

Personal loans are versatile financial tools that can be used for various purposes, including debt consolidation, home improvement, medical expenses, or even a vacation. They are typically unsecured loans, meaning they are not backed by collateral.

- Purpose: Personal loans offer flexibility, allowing borrowers to use the funds for a wide range of needs.

- Collateral: Unsecured loans are not backed by any asset, making them a good option for borrowers with good credit.

- Interest Rates: Interest rates vary depending on the borrower’s credit score, loan amount, and repayment term.

Unsecured Loans

Unsecured loans, as discussed previously, are not backed by any collateral. This means that the lender relies solely on the borrower’s creditworthiness to approve the loan.

- Purpose: Unsecured loans are commonly used for debt consolidation, medical expenses, home improvements, or unexpected expenses.

- Collateral: These loans are not secured by any asset, which can lead to higher interest rates compared to secured loans.

- Interest Rates: Interest rates are generally higher than secured loans due to the increased risk for the lender.

Commercial Loans

Commercial loans are designed specifically for businesses. These loans can be used for various purposes, such as purchasing equipment, expanding operations, or covering working capital needs.

- Purpose: Commercial loans are tailored to meet the specific needs of businesses, providing capital for growth and expansion.

- Collateral: Commercial loans can be secured or unsecured, depending on the lender and the loan amount.

- Interest Rates: Interest rates vary based on the borrower’s creditworthiness, loan amount, and the business’s financial performance.

Student Loans

Student loans are designed to help individuals finance their education. They are typically offered by the government or private lenders and are often subsidized or unsubsidized.

- Purpose: Student loans are specifically for covering education expenses, including tuition, fees, books, and living costs.

- Collateral: Student loans are typically unsecured loans, meaning they are not backed by any collateral.

- Interest Rates: Interest rates vary depending on the type of loan (federal or private) and the borrower’s financial situation.

Considerations Before Applying for a Loan

Taking out a loan is a significant financial decision, and it’s crucial to carefully consider your options before applying. By evaluating your financial situation and needs, comparing loan offers, and understanding the terms and fees, you can make an informed decision that aligns with your financial goals.

Evaluating Your Financial Situation and Needs

Before applying for a loan, it’s essential to assess your current financial situation and determine your borrowing needs. This involves understanding your income, expenses, debt obligations, and credit score.

- Income and Expenses: Analyze your monthly income and expenses to determine your available funds for loan repayments. Consider factors like your salary, other sources of income, fixed expenses (rent, utilities), and discretionary spending.

- Debt Obligations: Review your existing debts, such as credit card balances, student loans, or personal loans. Calculate your debt-to-income ratio (DTI), which represents the percentage of your monthly income allocated to debt payments. A lower DTI generally indicates a stronger financial position.

- Credit Score: Your credit score plays a significant role in loan eligibility and interest rates. A higher credit score typically leads to more favorable loan terms. Check your credit report for accuracy and identify any errors that could be affecting your score.

- Loan Purpose: Clearly define the purpose of the loan. Whether it’s for debt consolidation, home improvement, medical expenses, or other needs, understanding the reason for borrowing will help you choose the right loan type and amount.

Comparing Loan Offers from Multiple Lenders

Once you’ve assessed your financial situation, it’s essential to compare loan offers from multiple lenders to find the best terms. Lenders have varying interest rates, fees, repayment terms, and eligibility criteria.

- Interest Rates: Interest rates are a crucial factor affecting the overall cost of a loan. Lower interest rates translate to lower monthly payments and less overall interest paid. Compare APR (Annual Percentage Rate) across different lenders to determine the most favorable rate.

- Fees: Lenders may charge various fees, such as origination fees, late payment fees, or prepayment penalties. Understand the specific fees associated with each loan offer and factor them into your overall cost calculation.

- Repayment Terms: Consider the loan’s repayment term, which refers to the duration of the loan. Shorter terms generally result in higher monthly payments but lower overall interest paid. Longer terms offer lower monthly payments but lead to higher overall interest costs.

- Eligibility Criteria: Ensure you meet the eligibility requirements for each lender. Factors like credit score, income, and debt-to-income ratio are often considered.

Understanding Loan Terms and Fees

Before accepting a loan offer, thoroughly review the loan agreement and understand all the terms and fees.

- Loan Amount: Confirm the total loan amount you’ll receive.

- Interest Rate: Understand the interest rate, including the APR (Annual Percentage Rate), which reflects the total cost of borrowing.

- Repayment Schedule: Review the repayment schedule, including the monthly payment amount, due date, and the total number of payments.

- Fees: Be aware of any fees associated with the loan, such as origination fees, late payment fees, prepayment penalties, or annual fees.

- Loan Agreement: Carefully read the loan agreement and understand all the terms and conditions before signing.

Finding the best online lender for unsecured loans with quick approval involves a careful assessment of your individual needs and financial situation. By understanding the factors that influence loan approval, comparing offers from multiple lenders, and taking steps to improve your creditworthiness, you can navigate this process with confidence. Remember, securing a loan should be a responsible decision, so always consider the terms and conditions carefully and ensure you can comfortably manage the repayment obligations.

Essential FAQs

What are the risks of unsecured loans?

Unsecured loans come with higher interest rates and potentially stricter repayment terms compared to secured loans. If you fail to make payments, your credit score can suffer, and you may face legal action.

How can I improve my chances of getting a quick loan approval?

Focus on improving your credit score, ensuring a steady income, and minimizing your debt-to-income ratio. Having a good credit history and a solid financial track record will increase your chances of approval.

What is the difference between an unsecured loan and a secured loan?

An unsecured loan is not backed by collateral, meaning the lender doesn’t have any specific assets to seize if you default on payments. A secured loan, on the other hand, requires you to pledge an asset as collateral, such as a car or house.

Are there any hidden fees associated with unsecured loans?

Always review the loan agreement carefully for any hidden fees, such as origination fees, late payment fees, or prepayment penalties.