Navigating the world of commercial loans can be daunting, especially when deciding between short-term and long-term options. Each type offers distinct advantages and disadvantages, impacting your business’s cash flow, flexibility, and overall financial health. This guide will help you understand the key differences, analyze your business needs, and ultimately make an informed decision.

We’ll explore the various loan types available, from lines of credit to commercial mortgages, examining their features, benefits, and drawbacks. We’ll also discuss factors to consider when evaluating loan options, such as interest rates, repayment terms, and your business’s financial goals. By the end, you’ll be equipped with the knowledge to choose the loan that best aligns with your business’s unique circumstances and sets you on a path for success.

Understanding Short-Term and Long-Term Commercial Loans

Choosing between a short-term and long-term commercial loan is a crucial decision for any business owner. Understanding the key differences between these loan types can help you select the best option for your specific needs.

Key Differences Between Short-Term and Long-Term Commercial Loans

Short-term and long-term commercial loans differ significantly in their terms, interest rates, and repayment schedules. These differences are Artikeld in the table below:

Loan Term Comparison

| Loan Type | Loan Term | Interest Rate | Repayment Schedule |

|---|---|---|---|

| Short-Term Loan | Less than 1 year | Generally higher | Monthly or quarterly installments |

| Long-Term Loan | 1 year or more | Generally lower | Monthly installments over the loan term |

Common Business Scenarios for Each Loan Type

Short-term and long-term commercial loans are designed to address different business needs.

- Short-Term Loans: These loans are suitable for financing short-term needs such as inventory purchases, seasonal cash flow fluctuations, or covering unexpected expenses. Examples include:

- Working Capital Loans: These loans help businesses manage their day-to-day operations and cover expenses like payroll, rent, and utilities.

- Seasonal Loans: These loans are designed to help businesses meet seasonal demand increases, such as during the holiday season.

- Bridge Loans: These loans provide temporary financing while businesses wait for other funding sources, such as a larger loan or an equity investment.

- Long-Term Loans: These loans are used for financing long-term investments, such as purchasing equipment, expanding facilities, or acquiring another business. Examples include:

- Equipment Loans: These loans help businesses purchase equipment like machinery, vehicles, and computers.

- Real Estate Loans: These loans are used to finance the purchase or renovation of commercial properties.

- Business Acquisition Loans: These loans are used to finance the acquisition of another business.

Factors to Consider When Choosing

Choosing between a short-term and long-term commercial loan is a crucial decision for any business. The right choice depends on your specific needs and circumstances. Here are some key factors to consider:

Identifying Your Business’s Financial Needs

Understanding your business’s financial needs is essential to determine the appropriate loan type. Ask yourself the following:

- What is the purpose of the loan? Are you looking to finance a specific project, expand your operations, or cover short-term cash flow needs?

- How much money do you need? The loan amount will directly impact your repayment schedule and overall cost.

- What is your repayment capacity? Assess your cash flow and ability to make regular payments.

The Impact of Interest Rates and Loan Terms on Cash Flow

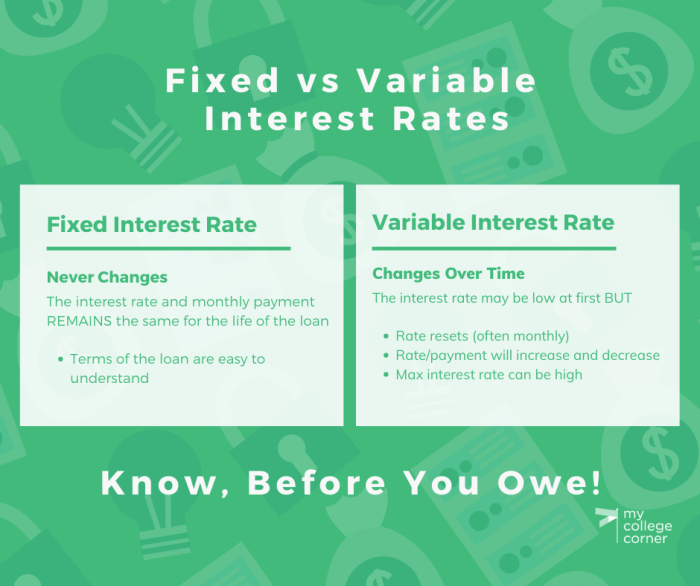

Interest rates and loan terms play a significant role in your business’s cash flow.

- Short-term loans generally have higher interest rates than long-term loans, but the repayment period is shorter. This can make them more expensive in the long run but provide flexibility for short-term needs.

- Long-term loans typically have lower interest rates but come with longer repayment terms. This can lower your monthly payments but increase the total interest paid over the life of the loan.

Comparing Pros and Cons of Each Loan Type

Weighing the pros and cons of each loan type can help you make an informed decision.

- Short-term loans offer flexibility and can be a good option for covering temporary cash flow gaps. However, they often come with higher interest rates and a shorter repayment period, which can create a higher repayment burden.

- Long-term loans provide lower interest rates and longer repayment terms, reducing your monthly payments and easing the repayment burden. However, they can be less flexible and may not be suitable for short-term needs.

Long-Term Loan Considerations

Long-term loans offer businesses a way to finance significant investments with predictable monthly payments and potentially lower interest rates compared to short-term options. These loans are typically designed for projects or assets with a longer lifespan, such as real estate, equipment, or expansion initiatives.

Types of Long-Term Loans

Long-term loans come in various forms, each tailored to specific needs and purposes. Here are some common types:

- Commercial Mortgages: These loans are specifically designed for purchasing commercial real estate, such as office buildings, retail spaces, or industrial facilities. They typically have longer terms, often ranging from 10 to 30 years, and offer fixed or adjustable interest rates.

- Equipment Financing: This type of loan helps businesses acquire essential equipment, machinery, or vehicles. Equipment financing often comes with lower interest rates than unsecured loans and can be structured as a lease or a loan.

- Term Loans: Term loans are versatile and can be used for various purposes, including business expansion, working capital, or debt consolidation. They offer a fixed amount of money with a predetermined repayment schedule and interest rate.

| Loan Type | Features | Uses |

|---|---|---|

| Commercial Mortgages | Long terms (10-30 years), fixed or adjustable interest rates, secured by real estate | Purchasing commercial real estate (office buildings, retail spaces, industrial facilities) |

| Equipment Financing | Lower interest rates than unsecured loans, structured as a lease or loan, secured by equipment | Acquiring essential equipment, machinery, or vehicles |

| Term Loans | Fixed amount of money, predetermined repayment schedule, fixed or variable interest rates | Business expansion, working capital, debt consolidation, general business needs |

Additional Loan Types

While commercial loans are specifically designed for businesses, other loan options are available for individuals and various purposes. These loans can be helpful for personal needs, education, or even for business-related expenses when traditional commercial loans aren’t feasible.

Personal Loans

Personal loans are versatile financial instruments that can be used for various purposes, including debt consolidation, home improvements, medical expenses, or even vacations. They are typically unsecured loans, meaning they are not backed by collateral, and are offered by banks, credit unions, and online lenders. Here’s a breakdown of key characteristics of personal loans:* Eligibility criteria: Lenders assess factors like credit score, income, debt-to-income ratio, and credit history.

A good credit score is usually required for lower interest rates.

Interest rates

Interest rates vary based on creditworthiness and the lender. Generally, borrowers with good credit scores receive lower rates.

Repayment terms

Repayment terms can range from a few months to several years, depending on the loan amount and lender. Personal loans differ from commercial loans in their intended use. They are primarily for individual needs, while commercial loans are for business purposes.

Unsecured Loans

Unsecured loans, as the name suggests, are not backed by any collateral. This means the lender relies solely on the borrower’s creditworthiness for repayment. Here’s a comparison of unsecured loans with other loan types:* Eligibility criteria: Similar to personal loans, eligibility depends on factors like credit score, income, and debt-to-income ratio.

Interest rates

Interest rates are generally higher than secured loans due to the higher risk for the lender.

Repayment terms

Repayment terms can vary depending on the lender and loan amount. Unsecured loans are often used for short-term needs, like covering unexpected expenses or consolidating debt. They differ from commercial loans by not requiring collateral and typically having shorter repayment terms.

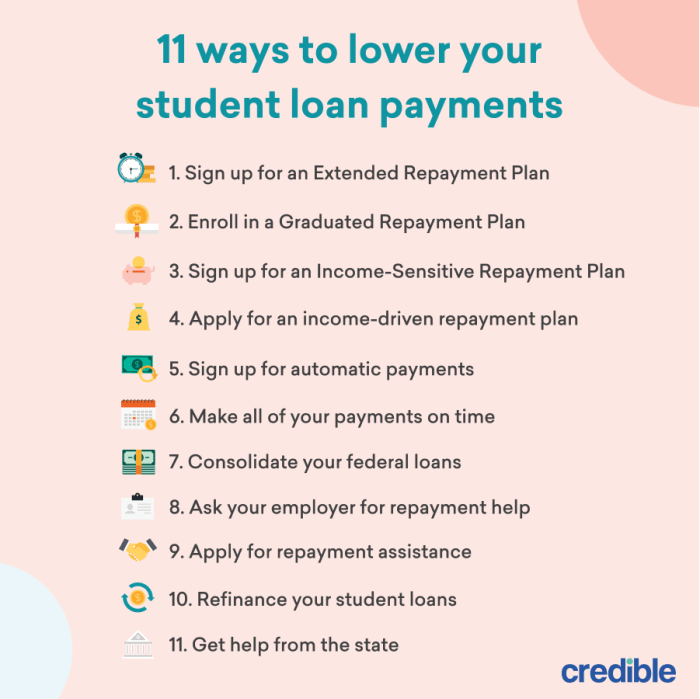

Student Loans

Student loans are specifically designed to help students finance their education. They are offered by the government (federal loans) or private lenders. Here’s a comparison of student loans with other loan types:* Eligibility criteria: Eligibility for federal loans is based on factors like enrollment status, financial need, and citizenship. Private loans have their own eligibility criteria, often requiring a credit history or co-signer.

Interest rates

Interest rates for federal loans are usually fixed and lower than private loans. Private loan interest rates can be variable and may be higher based on creditworthiness.

Repayment terms

Federal student loans have flexible repayment options, including income-driven repayment plans, while private loans typically have fixed repayment terms. Student loans are distinct from commercial loans as they are solely for educational purposes and often come with unique repayment terms and interest rates.

Evaluating Your Options

Once you understand the characteristics of both short-term and long-term commercial loans, it’s time to carefully evaluate your options and choose the best fit for your business. This process involves considering various factors and comparing different loan offers.

Comparing Loan Offers

It’s crucial to compare loan offers from multiple lenders to secure the best terms for your business.

- Interest Rates: Interest rates are a significant factor in determining the overall cost of a loan. Compare interest rates from different lenders and look for the lowest rates possible. Consider fixed vs. variable rates based on your business’s financial outlook and risk tolerance.

- Loan Fees: Lenders often charge various fees associated with loan origination, processing, and closing. These fees can add up, so compare them across different offers and choose the loan with the lowest fees.

- Loan Term: The loan term determines the repayment period. Choose a term that aligns with your business’s cash flow and financial goals. A shorter term may lead to higher monthly payments but lower overall interest costs. Conversely, a longer term may have lower monthly payments but higher interest costs over time.

- Repayment Schedule: Understand the repayment schedule and whether it aligns with your business’s cash flow. Some lenders offer flexible repayment options, such as interest-only payments or balloon payments, while others have stricter schedules. Choose a repayment schedule that fits your business’s financial planning.

- Collateral Requirements: Some lenders require collateral, such as property or equipment, as security for the loan. Evaluate the collateral requirements and ensure you can meet them. If you have limited collateral, consider seeking a loan that doesn’t require it or exploring alternative financing options.

- Loan Covenants: Loan covenants are terms and conditions that lenders impose on borrowers. These covenants can restrict certain business activities or financial decisions. Carefully review the covenants and ensure you can comply with them.

Negotiating Loan Terms

Negotiating favorable loan terms with lenders can help you secure a loan that meets your business needs.

- Shop Around: Get quotes from multiple lenders to compare rates, fees, and terms. This competition can motivate lenders to offer more favorable terms.

- Strong Credit History: A good credit history is crucial for securing favorable loan terms. Maintain a healthy credit score by paying bills on time and managing your credit utilization.

- Solid Business Plan: A well-written business plan demonstrates your understanding of the market, your financial projections, and your ability to repay the loan. It helps lenders assess your creditworthiness and increases your chances of getting favorable terms.

- Negotiate Interest Rates: If you have a good credit history and a strong business plan, you may be able to negotiate a lower interest rate. Consider highlighting your business’s strengths and potential for growth.

- Ask for Fee Waivers: Some lenders may be willing to waive certain fees, such as origination fees or closing costs. Negotiate these fees to reduce the overall cost of the loan.

- Explore Alternative Financing Options: If you can’t secure favorable terms from traditional lenders, explore alternative financing options such as peer-to-peer lending, crowdfunding, or invoice factoring.

Securing the Best Loan

Once you’ve compared loan offers and negotiated terms, you can make an informed decision about the best loan for your business.

- Align with Business Needs: Choose a loan that aligns with your business’s short-term or long-term goals. If you need funding for immediate expenses, a short-term loan may be suitable. If you need funding for long-term investments, a long-term loan may be a better choice.

- Evaluate Financial Capacity: Assess your business’s ability to repay the loan. Consider your current cash flow, projected revenue, and any other financial obligations. Choose a loan with a repayment schedule that you can comfortably meet.

- Understand Loan Covenants: Carefully review the loan covenants and ensure you can comply with them. Some covenants can restrict your business’s operations or financial decisions, so it’s crucial to understand them before signing the loan agreement.

- Seek Professional Advice: If you’re unsure about the best loan for your business, consult with a financial advisor or a business lawyer. They can provide expert guidance and help you make informed decisions.

Ultimately, the choice between short-term and long-term commercial loans hinges on your specific business needs, financial situation, and future plans. By carefully evaluating your options, considering your financial goals, and negotiating favorable terms with lenders, you can secure the loan that best supports your business’s growth and prosperity. Remember, taking the time to understand your options and make an informed decision is crucial for ensuring long-term financial stability and success.

FAQ Summary

What are the typical interest rates for short-term and long-term commercial loans?

Short-term loans typically have higher interest rates than long-term loans due to their shorter repayment periods and higher risk for lenders. Interest rates vary based on factors like your credit score, loan amount, and lender.

How can I improve my chances of getting a loan approved?

To increase your chances of loan approval, maintain a good credit score, provide a strong business plan, and demonstrate a solid track record of financial management. Having collateral to offer can also improve your chances.

What are some common mistakes to avoid when applying for a commercial loan?

Common mistakes include not thoroughly researching loan options, neglecting to compare interest rates and terms, and not understanding the loan’s repayment obligations. It’s also crucial to avoid overextending yourself and taking on more debt than you can comfortably manage.

How can I find the best loan for my business?

Shop around and compare offers from multiple lenders. Consider factors like interest rates, fees, repayment terms, and the lender’s reputation. You can also consult with a financial advisor or business consultant for guidance.