Navigating the world of personal finance can be overwhelming, especially when it comes to understanding the intricacies of loans. A crucial factor that often determines the cost of borrowing is your credit score. This seemingly simple number holds immense power, influencing the interest rates you’ll face on unsecured loans. Let’s delve into the complex relationship between credit scores and unsecured loans, unraveling the factors that determine your borrowing power and how you can improve your financial standing.

Unsecured loans, unlike mortgages or auto loans, are not backed by collateral. This means lenders rely heavily on your creditworthiness to assess the risk of lending you money. A higher credit score signifies a lower risk to the lender, leading to more favorable interest rates and potentially easier loan approvals. Conversely, a lower credit score can result in higher interest rates, making borrowing more expensive.

Understanding this dynamic is essential for making informed financial decisions.

Introduction to Credit Scores and Unsecured Loans

Your credit score is a numerical representation of your creditworthiness, a vital aspect of your financial well-being. It reflects your ability to manage debt responsibly and serves as a gauge for lenders to assess the risk associated with lending you money. This score is calculated based on various factors like payment history, credit utilization, and length of credit history. A higher credit score indicates a lower risk for lenders, potentially leading to better loan terms and lower interest rates.Unsecured loans, unlike secured loans, are not backed by collateral like a house or car.

These loans are granted based solely on your creditworthiness and rely heavily on your credit score. The interest rates on these loans are determined by your credit score, among other factors.

Credit Scores and Unsecured Loan Interest Rates

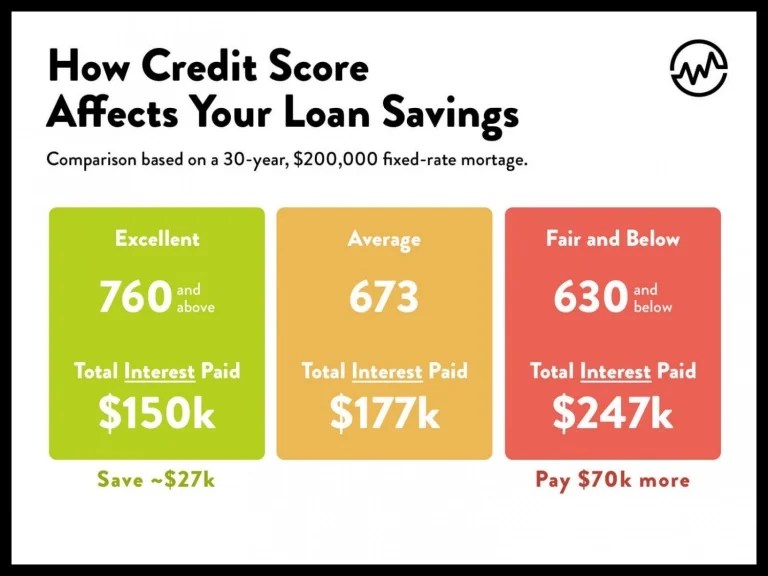

Your credit score plays a pivotal role in determining the interest rate you’ll receive on an unsecured loan. Lenders use your credit score as a primary indicator of your creditworthiness and risk profile. A higher credit score signifies a lower risk, allowing lenders to offer you a more favorable interest rate. Conversely, a lower credit score indicates a higher risk, leading to higher interest rates.For example, a person with a credit score of 750 or higher might qualify for an unsecured personal loan with an interest rate of 5-7%, while someone with a score of 600 or lower might face interest rates as high as 15-25%.

This substantial difference highlights the importance of maintaining a good credit score to secure favorable loan terms.

How Credit Scores Influence Interest Rates

Your credit score is a numerical representation of your creditworthiness, reflecting your history of borrowing and repaying debt. Lenders use this score to assess the risk associated with lending you money. A higher credit score indicates a lower risk, making you a more attractive borrower, while a lower score signals a higher risk, potentially leading to higher interest rates.

Credit Scoring Model and Its Components

Credit scoring models are complex algorithms that consider various factors to determine your credit score. The most widely used model in the United States is the FICO score, which is based on five key components:

- Payment History (35%): This is the most important factor, reflecting your ability to make payments on time. Late payments, missed payments, and defaults negatively impact your score.

- Amounts Owed (30%): This component considers the amount of credit you’re currently using compared to your available credit limit. A high credit utilization ratio (using a large portion of your available credit) can lower your score.

- Length of Credit History (15%): A longer credit history demonstrates a consistent track record of responsible borrowing, which can positively influence your score.

- Credit Mix (10%): Having a mix of different types of credit, such as credit cards, loans, and mortgages, can indicate a diverse and responsible borrowing profile.

- New Credit (10%): Frequent applications for new credit can negatively impact your score, as it suggests potential risk-taking behavior.

Credit Score Ranges and Interest Rates

The credit score range generally falls between 300 and 850, with higher scores indicating better creditworthiness. Lenders typically categorize borrowers into different risk tiers based on their credit scores, which directly impacts the interest rates they offer on unsecured loans.

- Excellent Credit (740-850): Borrowers with excellent credit scores qualify for the lowest interest rates on unsecured loans, reflecting their low risk profile. They may also be eligible for additional benefits, such as lower fees and higher credit limits.

- Good Credit (670-739): Individuals with good credit scores are considered relatively low risk, and they often receive competitive interest rates on unsecured loans.

- Fair Credit (580-669): Borrowers with fair credit scores may face higher interest rates compared to those with good or excellent credit, as they represent a moderate risk to lenders.

- Poor Credit (300-579): Individuals with poor credit scores are considered high risk, and they often receive the highest interest rates on unsecured loans. They may also face difficulty securing loans altogether.

Factors Influencing Credit Scores and Their Impact on Interest Rates

Several factors can influence your credit score and subsequently impact the interest rates you qualify for on unsecured loans. Understanding these factors can help you make informed decisions to improve your creditworthiness and secure better loan terms.

- Late Payments: Late payments are a major detriment to your credit score. Even a single late payment can negatively impact your score, and multiple late payments can significantly lower it. This can lead to higher interest rates on future loans.

- High Credit Utilization: A high credit utilization ratio (using a large portion of your available credit) indicates a high level of debt, which can negatively impact your credit score. Lenders may perceive this as a risk factor and charge higher interest rates.

- Opening Too Many New Credit Accounts: Frequent applications for new credit can lower your score, as it signals potential risk-taking behavior. Lenders may view this as a sign of financial instability and charge higher interest rates.

- Debt Collection Accounts: Debt collection accounts, such as unpaid medical bills or outstanding loans, can significantly damage your credit score. These accounts reflect a history of non-payment, making you a higher risk borrower and leading to higher interest rates.

Understanding the Impact of Credit Score on Loan Costs

Your credit score is a numerical representation of your creditworthiness, and it plays a crucial role in determining the interest rate you’ll be offered on an unsecured loan. Lenders use this score to assess your credit history and determine the risk of lending to you.

A higher credit score indicates a lower risk to the lender, resulting in more favorable loan terms, including a lower interest rate. Conversely, a lower credit score signals a higher risk, leading to less favorable terms, such as a higher interest rate.

The Financial Benefits of Maintaining a Good Credit Score

Maintaining a good credit score offers numerous financial advantages.

- Lower Interest Rates on Loans: A good credit score translates to lower interest rates on loans, such as personal loans, mortgages, and credit cards. This means you’ll pay less in interest over the life of the loan, saving you significant money.

- Easier Loan Approval: Lenders are more likely to approve your loan application if you have a good credit score. This gives you greater access to financing options when you need them.

- Lower Insurance Premiums: In some cases, a good credit score can even lead to lower insurance premiums, such as for car or homeowners insurance.

- Better Rental Opportunities: Landlords may use your credit score to assess your financial responsibility and may be more likely to rent to you if you have a good score.

The Impact of a Lower Credit Score on Loan Costs

A lower credit score can significantly impact your loan costs.

- Higher Interest Rates: Lenders perceive a lower credit score as a higher risk and charge higher interest rates to compensate. This means you’ll pay more in interest over the life of the loan, increasing your overall borrowing cost.

- Limited Loan Options: Some lenders may not be willing to offer loans to individuals with lower credit scores. This can limit your options and make it difficult to secure financing when you need it.

- Higher Loan Fees: Lenders may also charge higher fees for loans to individuals with lower credit scores. These fees can add to the overall cost of borrowing.

It’s crucial to remember that a lower credit score can have a significant impact on your financial well-being. It can lead to increased borrowing costs, limited access to credit, and higher insurance premiums.

Strategies for Improving Credit Scores and Securing Lower Interest Rates

A higher credit score can translate into significant savings on unsecured loans. By taking proactive steps to improve your creditworthiness, you can potentially unlock lower interest rates and more favorable loan terms.

Improving Your Credit Score

Boosting your credit score is a journey that requires consistent effort and responsible financial practices. Here are some practical strategies to help you improve your credit score:

- Pay Bills on Time: Your payment history accounts for a significant portion of your credit score. Make all payments on time, whether it’s your credit card bills, utility bills, or loan payments. Setting up automatic payments or reminders can help ensure you don’t miss any deadlines.

- Reduce Existing Debt: High credit utilization (the amount of credit you’re using compared to your available credit limit) can negatively impact your score. Aim to keep your credit utilization below 30%. Consider strategies like debt consolidation or paying down balances with higher interest rates first.

- Avoid New Credit Applications: Each time you apply for new credit, a hard inquiry is placed on your credit report, which can temporarily lower your score. Avoid applying for multiple credit cards or loans within a short period.

- Monitor Your Credit Report Regularly: Errors on your credit report can negatively affect your score. Review your credit report from all three major credit bureaus (Experian, Equifax, and TransUnion) at least once a year to ensure accuracy.

Benefits of Credit Monitoring Services

Credit monitoring services can be valuable tools for safeguarding your credit and detecting potential issues early on. Here’s how they can help:

- Real-Time Alerts: Credit monitoring services can alert you to suspicious activity on your credit report, such as unauthorized credit applications or changes in your account information. This can help you catch identity theft quickly and take steps to mitigate the damage.

- Credit Score Tracking: These services provide regular updates on your credit score, allowing you to monitor your progress as you implement credit improvement strategies.

- Credit Report Access: Credit monitoring services typically offer easy access to your credit report, making it convenient to review for errors or discrepancies.

Impact of Credit Score Improvement on Loan Approval and Interest Rates

A higher credit score can significantly improve your chances of loan approval and secure lower interest rates.

- Increased Loan Approval Odds: Lenders often have minimum credit score requirements for loan approval. A higher score increases your likelihood of meeting those requirements and being approved for the loan you need.

- Lower Interest Rates: Lenders view borrowers with higher credit scores as less risky. This translates into lower interest rates, which can save you significant money over the life of your loan.

- More Favorable Loan Terms: A strong credit score can also lead to more favorable loan terms, such as lower origination fees or longer repayment periods.

Comparing Interest Rates Across Loan Types

Unsecured loans come in various forms, each catering to different financial needs. Understanding the differences in interest rates across these loan types is crucial for making informed borrowing decisions. While your credit score plays a significant role, other factors contribute to the variations in interest rates for different unsecured loan types.

Interest Rate Differences Across Loan Types

The interest rate on an unsecured loan is influenced by several factors, including the type of loan, the lender’s risk assessment, and current market conditions. Here’s a breakdown of common unsecured loan types and their typical interest rate ranges:

- Personal Loans: These loans offer flexible borrowing for various purposes, such as debt consolidation, home improvements, or medical expenses. Interest rates typically range from 5% to 36%, depending on factors like credit score, loan amount, and loan term.

- Credit Cards: Credit cards provide revolving credit, allowing you to make purchases and pay them back over time. Interest rates on credit cards are generally higher than personal loans, ranging from 15% to 30% or more. The interest rate on a credit card is often variable and can change based on market conditions and your creditworthiness.

- Payday Loans: Payday loans are short-term, high-interest loans designed to bridge a gap until your next paycheck. These loans typically carry extremely high interest rates, often exceeding 400%, due to the high risk associated with short-term lending.

- Cash Advance Loans: Similar to payday loans, cash advance loans are short-term loans that offer quick access to cash. Interest rates on cash advance loans are also very high, often exceeding 200%.

Impact of Credit Score on Loan Approval

Your credit score is a crucial factor in determining whether you’ll be approved for an unsecured loan. Lenders use your credit history to assess your risk as a borrower. A low credit score can make it difficult to get approved for a loan, or you may be offered a loan with unfavorable terms, such as a higher interest rate.

The Importance of Building a Good Credit History for Loan Applications

A good credit history is essential for securing favorable loan terms. Lenders look for borrowers with a track record of responsible financial behavior, including making timely payments on debts and managing credit responsibly. A strong credit score demonstrates your ability to repay borrowed funds, making you a more attractive borrower.

Importance of Credit Score Management

Your credit score is a crucial element in securing favorable loan terms, and it’s not just a one-time event. Maintaining a healthy credit score is an ongoing process that requires proactive management and consistent attention. A good credit score can lead to lower interest rates, better loan approval odds, and greater financial flexibility. Let’s explore how you can actively manage your credit score for long-term financial benefits.

Strategies for Proactive Credit Score Management

Proactive credit score management involves taking steps to consistently improve and maintain your credit score. This includes understanding your credit report, identifying areas for improvement, and making informed financial decisions.

- Regularly Review Your Credit Report: Access your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) at least annually. Review it for any errors, inconsistencies, or fraudulent activity. Dispute any inaccuracies with the credit bureaus to ensure your report is accurate and reflects your true credit history.

- Pay Bills on Time: Paying your bills on time is one of the most significant factors impacting your credit score. Set reminders, automate payments, or use a bill payment service to avoid late payments. Even a single late payment can negatively impact your credit score.

- Keep Credit Utilization Low: Your credit utilization ratio (the amount of credit you use compared to your total available credit) is a crucial factor in credit scoring. Aim to keep your credit utilization ratio below 30%. This indicates responsible credit management and can significantly boost your credit score.

- Avoid Opening Too Many New Accounts: Every time you apply for a new credit card or loan, a hard inquiry is placed on your credit report. Multiple hard inquiries can lower your credit score. Avoid opening too many new accounts within a short period.

- Consider a Secured Credit Card: If you have limited credit history or a low credit score, a secured credit card can be a good option. These cards require a security deposit, which acts as collateral. Responsible use of a secured credit card can help build your credit history and improve your credit score over time.

Long-Term Benefits of Maintaining a Healthy Credit Score

Maintaining a healthy credit score offers numerous long-term financial benefits, including:

- Lower Interest Rates on Loans: A good credit score unlocks access to lower interest rates on loans, including mortgages, auto loans, and personal loans. Lower interest rates can save you thousands of dollars in interest charges over the life of a loan.

- Improved Loan Approval Odds: Lenders are more likely to approve loan applications from borrowers with good credit scores. A healthy credit score increases your chances of securing the financing you need for major purchases, such as a home or car.

- Greater Financial Flexibility: A good credit score provides you with greater financial flexibility. You’ll have more options when it comes to credit cards, loans, and other financial products. This flexibility can be crucial in times of financial need or unexpected expenses.

- Easier Access to Rental Housing: Landlords often use credit scores to assess potential tenants. A good credit score can increase your chances of being approved for a rental property and securing favorable lease terms.

- Potential for Lower Insurance Premiums: Some insurance companies consider credit scores when determining insurance premiums. A good credit score could lead to lower premiums for auto insurance, homeowners insurance, and other types of insurance.

“A good credit score is like a passport to financial freedom. It opens doors to better interest rates, more loan options, and greater financial flexibility.”

In conclusion, your credit score plays a pivotal role in determining the cost of unsecured loans. By maintaining a good credit score, you can unlock lower interest rates, saving money over the life of your loan. It’s crucial to understand the factors that impact your credit score and take proactive steps to improve it. From paying bills on time to managing debt responsibly, these actions can significantly influence your borrowing power.

Remember, a healthy credit score is a valuable asset, opening doors to financial opportunities and helping you achieve your financial goals.

User Queries

What is a good credit score for unsecured loans?

Generally, a credit score of 700 or above is considered good for securing favorable interest rates on unsecured loans. However, lenders may have varying criteria, so it’s always best to check with them directly.

How long does it take to improve my credit score?

Improving your credit score takes time and consistent effort. It’s a gradual process, and results may not be immediate. However, with dedicated effort, you can see significant improvements within a few months to a year.

Can I get a loan with a low credit score?

While securing a loan with a low credit score can be challenging, it’s not impossible. You may qualify for a loan with a higher interest rate or may need to explore alternative financing options, such as a secured loan or a loan from a credit union.