Navigating the world of personal loans can be a daunting task, especially for self-employed individuals. Unlike traditional employees with steady paychecks, self-employed borrowers often face unique challenges when seeking financing. Lenders may require additional documentation to verify income and financial stability, making the process more complex. This guide aims to demystify the process, providing a comprehensive overview of the steps involved in securing a personal loan as a self-employed individual.

We’ll delve into the key eligibility criteria, explore different loan types, and guide you through the application process. You’ll learn about essential documentation, understand interest rates and loan terms, and discover alternative funding options if traditional loans aren’t readily available. By understanding the nuances of personal loans for self-employed borrowers, you can confidently navigate the process and secure the financial resources you need to achieve your goals.

Understanding Self-Employment and Personal Loans

Being self-employed can be incredibly rewarding, but it also comes with unique challenges, especially when it comes to securing a personal loan. Unlike traditional employees with consistent paychecks and W-2 forms, self-employed individuals face a different set of requirements and considerations when applying for financial assistance.

Challenges for Self-Employed Borrowers

Self-employed individuals often encounter obstacles when applying for personal loans due to the nature of their income and financial reporting. Here are some key challenges:

- Income Verification: Lenders typically require proof of consistent income, which can be challenging for self-employed individuals whose income fluctuates. This can be especially difficult if you are a freelancer or gig worker, as your income may be irregular and not easily documented.

- Credit History: A strong credit score is essential for any loan application, but it’s particularly crucial for self-employed individuals. Lenders may use your credit history to assess your financial responsibility and ability to repay the loan.

- Financial Stability: Lenders may also consider your financial stability, which can be more challenging to demonstrate if you are self-employed. Factors like business expenses, fluctuating income, and the lack of a consistent paycheck can make it difficult to establish a clear picture of your financial situation.

The Importance of a Good Credit Score and Financial History

Having a good credit score and a solid financial history is vital for self-employed individuals seeking personal loans. A good credit score indicates to lenders that you are a responsible borrower who has a track record of managing your finances well. A strong credit history demonstrates your ability to handle debt responsibly, making you a more attractive borrower.

- Increased Loan Approval Odds: A good credit score significantly increases your chances of loan approval. Lenders are more likely to approve loans to borrowers with a proven history of responsible financial management.

- Lower Interest Rates: A good credit score often translates into lower interest rates on your loan. This means you’ll pay less in interest over the life of the loan, saving you money in the long run.

- Improved Loan Terms: A solid credit history can also help you secure better loan terms, such as a longer repayment period or a lower down payment. This can make it easier to manage your debt and meet your financial goals.

Common Misconceptions about Personal Loans for Self-Employed Individuals

There are several misconceptions surrounding personal loans for self-employed individuals. Understanding these misconceptions can help you make informed decisions about your borrowing needs.

- “It’s impossible to get a personal loan if you’re self-employed.” While it may be more challenging, it’s not impossible. There are lenders who specialize in working with self-employed borrowers, and many traditional lenders are becoming more accommodating to this demographic.

- “Self-employed individuals always pay higher interest rates.” This is not always true. While higher interest rates may be more common, your interest rate will ultimately depend on your credit score, financial history, and the specific loan terms.

- “You need to have been self-employed for a certain amount of time to qualify for a loan.” There is no set timeframe. However, lenders may consider the length of time you’ve been self-employed as a factor in their decision-making process.

Eligibility Criteria for Self-Employed Borrowers

Lenders carefully evaluate self-employed individuals to assess their creditworthiness and ability to repay a personal loan. This evaluation process often involves examining various factors, including your income, credit history, and financial stability.

Income Verification

Lenders need to confirm your income to determine if you can afford the loan payments. They will often request documentation that demonstrates your income history and stability.

-

Criteria: Income History and Stability

Description: Lenders typically prefer borrowers with a consistent income history, demonstrating financial stability and the ability to meet loan obligations.

Required Documentation:- Tax returns (past 2-3 years): These documents provide a comprehensive overview of your income and expenses, allowing lenders to assess your financial situation.

- Profit and loss statements (past 12 months): These statements detail your business’s revenue and expenses, showcasing your income generation capacity.

- Bank statements: Bank statements provide evidence of your cash flow, including deposits and withdrawals, giving lenders insight into your financial activity.

Tips for Meeting the Criteria:

- Maintain accurate and organized financial records.

- Demonstrate a consistent income stream, ideally for a period of at least 12 months.

- Ensure your tax returns and financial statements are readily available for submission.

- Criteria: Credit Score Description: Your credit score is a numerical representation of your creditworthiness, reflecting your responsible borrowing and repayment history. Required Documentation:

- Credit report: This report details your credit history, including past loans, credit card usage, and payment behavior.

Tips for Meeting the Criteria:

- Maintain a good credit score by paying bills on time and keeping credit utilization low.

- Monitor your credit report regularly for any errors or discrepancies.

- Criteria: Debt-to-Income Ratio (DTI) Description: DTI measures the percentage of your monthly income that goes towards debt payments. A lower DTI generally indicates greater financial stability and a higher likelihood of loan repayment. Required Documentation:

- Proof of existing debt obligations: This includes loan statements, credit card statements, and other debt-related documents.

Tips for Meeting the Criteria:

- Reduce existing debt before applying for a personal loan.

- Consider consolidating high-interest debts to lower your monthly payments.

- Criteria: Business and Financial Stability Description: Lenders assess the stability of your business and your overall financial situation. This includes factors such as the length of time you’ve been self-employed, your business’s profitability, and your ability to manage finances. Required Documentation:

- Business plan: A well-structured business plan demonstrates your understanding of your business, its market, and your future plans.

- Financial statements (past 12 months): These statements provide a snapshot of your business’s financial health, including revenue, expenses, and profitability.

- Business licenses and permits: These documents verify the legality and legitimacy of your business operations.

Tips for Meeting the Criteria:

- Maintain accurate and up-to-date financial records.

- Demonstrate a history of consistent business operations and profitability.

- Develop a comprehensive business plan that Artikels your goals and strategies.

- Criteria: Collateral Description: Some lenders may require collateral, an asset that can be seized if you default on the loan. Collateral can be a valuable asset like real estate or a vehicle. Required Documentation:

- Proof of ownership of collateral: This can include a deed for real estate, a title for a vehicle, or other relevant documentation.

Tips for Meeting the Criteria:

- Consider offering collateral if you have a valuable asset and are seeking a larger loan amount.

- Be prepared to provide documentation verifying ownership of the collateral.

Choosing the Right Loan for Your Needs

Now that you understand the basics of personal loans for self-employed individuals, it’s time to dive into the different types available and find the one that best suits your financial situation.

Types of Personal Loans for Self-Employed Individuals

There are two main categories of personal loans: secured and unsecured.

- Secured Loans: These loans require collateral, which is an asset you pledge to the lender as a guarantee of repayment. If you default on the loan, the lender can seize your collateral. Examples of collateral include your home, car, or business equipment.

- Unsecured Loans: These loans don’t require collateral. Instead, lenders rely on your creditworthiness and income to determine your eligibility.

Comparing Secured and Unsecured Loans

The choice between a secured and unsecured loan depends on your individual circumstances and financial goals.

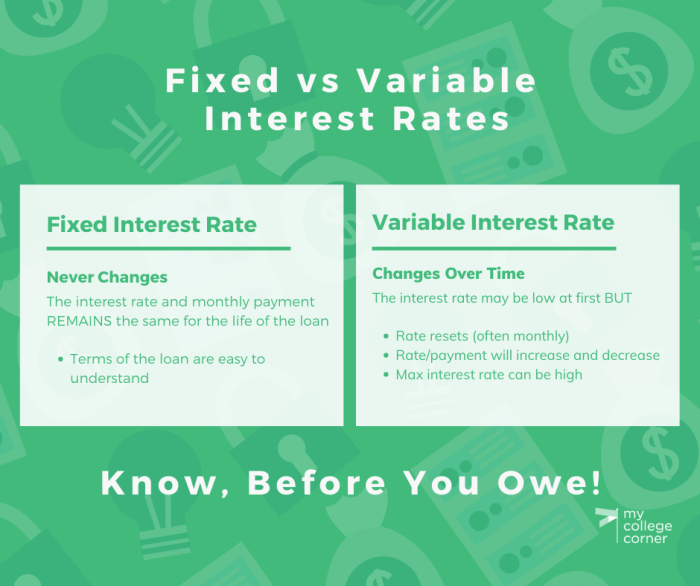

- Interest Rates: Secured loans typically have lower interest rates than unsecured loans. This is because the lender has less risk because they have collateral to fall back on if you default.

- Loan Terms: Both secured and unsecured loans can offer various loan terms, ranging from a few months to several years. The length of your loan term will influence your monthly payments and the total amount of interest you pay over the life of the loan.

- Repayment Options: Both types of loans may offer different repayment options, such as fixed monthly payments or variable payments. It’s essential to understand the repayment structure and ensure you can comfortably meet your obligations.

Key Features of Different Loan Types

The table below summarizes the key features of different types of personal loans available to self-employed individuals.

| Loan Type | Interest Rate | Loan Term | Repayment Options | Suitability for Self-Employed Borrowers |

|---|---|---|---|---|

| Secured Loan | Lower | Longer | Fixed or Variable | Good option for those with assets to pledge as collateral and seeking a lower interest rate. |

| Unsecured Loan | Higher | Shorter | Fixed or Variable | Suitable for those without collateral or who prefer a shorter loan term. |

| Home Equity Loan | Lower | Longer | Fixed | Good option for those with significant home equity and need a large loan amount. |

| Business Loan | Variable | Variable | Variable | Best for funding business expenses, but may have stricter eligibility requirements. |

Gathering Required Documentation

Getting a personal loan as a self-employed individual often requires more documentation than traditional employees. Lenders want to see proof of your income and financial stability, especially since you don’t have a regular paycheck or W-2 form.

Documentation Needed for Self-Employed Personal Loans

This documentation helps lenders assess your financial stability and determine your ability to repay the loan.

| Document Name | Purpose | Tips for Preparation |

|---|---|---|

| Tax Returns (Last 2-3 Years) | To verify your income and expenses, lenders look at your Schedule C or Schedule C-EZ (for sole proprietorships) or Form 1040 (for partnerships or corporations). | Organize your tax returns and ensure they are complete and accurate. You may also need to provide supporting documentation like receipts or invoices. |

| Bank Statements (Last 3-6 Months) | To review your cash flow, lenders examine your bank statements to see how much money you’re bringing in and how you’re spending it. | Ensure your bank statements are current and show a consistent flow of income. Consider consolidating accounts if you have multiple business accounts. |

| Profit and Loss Statement (P&L) | A P&L statement shows your business’s income and expenses over a specific period. It helps lenders understand your profitability and financial health. | Prepare a P&L statement that accurately reflects your business’s income and expenses. It can be a simple document or a more detailed financial statement. |

| Business License and/or EIN | Lenders need to verify that your business is legitimate and operating legally. | Provide copies of your business license and Employer Identification Number (EIN) to confirm your business’s legal status. |

| Credit Report | A credit report provides a detailed history of your creditworthiness, including your payment history, credit utilization, and credit inquiries. | Review your credit report for any errors and take steps to improve your credit score before applying for a loan. |

Application Process and Tips

Applying for a personal loan as a self-employed individual might seem daunting, but it’s a straightforward process if you’re prepared. Understanding the steps involved and taking proactive measures can significantly increase your chances of approval.

Application Process

The application process for a personal loan as a self-employed individual typically involves these steps:

- Pre-Application Research: Before you apply, research lenders who cater to self-employed borrowers. Compare interest rates, fees, loan terms, and eligibility requirements to find the best fit for your financial situation.

- Gather Required Documentation: Lenders will request specific documents to verify your income and creditworthiness. These may include:

- Recent tax returns (typically 2-3 years)

- Bank statements (showing business income and expenses)

- Profit and loss statements

- Business license or registration

- Proof of identity and address

- Complete the Loan Application: Once you’ve chosen a lender, carefully fill out the online or paper application form. Provide accurate and complete information.

- Submit Your Application: After completing the application, submit it along with the required documentation.

- Credit and Income Verification: The lender will review your application and verify your credit history and income. This may involve a hard credit inquiry, which can slightly impact your credit score.

- Loan Approval or Denial: The lender will notify you of their decision. If approved, you’ll receive a loan agreement outlining the terms and conditions.

- Loan Disbursement: Once you sign the loan agreement, the lender will typically deposit the loan funds into your bank account.

Tips for Streamlining the Application Process

- Maintain Good Credit: A strong credit score is essential for securing a favorable loan offer. Pay bills on time, keep credit utilization low, and avoid opening too many new accounts.

- Organize Your Finances: Gather all necessary documentation in advance, such as tax returns, bank statements, and business records. Having these documents readily available will expedite the application process.

- Shop Around: Compare loan offers from multiple lenders to secure the best interest rate and terms. Don’t hesitate to negotiate with lenders to try and improve the offer.

- Be Prepared to Provide Additional Information: Lenders may request additional information, such as business plans or financial projections, to assess your financial stability.

- Understand Loan Terms: Carefully review the loan agreement before signing. Pay attention to interest rates, fees, repayment terms, and any prepayment penalties.

Understanding Interest Rates and Loan Terms

Securing a personal loan as a self-employed individual often comes with a unique set of considerations, particularly when it comes to interest rates and loan terms. Understanding these factors is crucial for making informed decisions and securing a loan that aligns with your financial goals and circumstances.

Factors Influencing Interest Rates

Interest rates for self-employed borrowers are determined by a variety of factors, reflecting the lender’s assessment of your creditworthiness and the perceived risk associated with lending to someone with a less conventional income stream. Here are some key factors that influence interest rates:

- Credit Score: A strong credit score is a cornerstone of securing favorable interest rates. Lenders use your credit score as a gauge of your financial responsibility and repayment history. Maintaining a high credit score is paramount for self-employed individuals seeking loans.

- Income and Debt-to-Income Ratio (DTI): Lenders evaluate your income stability and debt obligations to assess your ability to repay the loan. A higher DTI, which is the percentage of your income dedicated to debt payments, can lead to higher interest rates.

- Length of Business Operation: The duration of your self-employment plays a significant role in lender perception. A longer track record of successful business operation demonstrates stability and financial responsibility, potentially leading to lower interest rates.

- Business Revenue and Profitability: Lenders often consider your business’s financial performance, such as revenue and profitability, as indicators of your ability to repay the loan. Strong financial performance can lead to more favorable terms.

- Loan Amount and Repayment Term: The amount you borrow and the repayment period influence interest rates. Larger loan amounts and longer repayment terms typically come with higher interest rates.

- Loan Type: Different types of personal loans, such as unsecured loans or secured loans, carry varying interest rates. Secured loans, backed by collateral, generally have lower interest rates due to reduced risk for the lender.

- Lender’s Policies and Market Conditions: Each lender has its own policies and underwriting criteria, which can affect interest rates. Market conditions, such as prevailing interest rates, also play a role.

Reviewing Loan Terms

Carefully reviewing the loan terms is essential to ensure the loan aligns with your financial situation and goals. Here’s what to consider:

- Interest Rate: The interest rate determines the cost of borrowing. A lower interest rate means you’ll pay less in total interest over the loan term. Compare interest rates from different lenders to find the most favorable option.

- Repayment Period: The repayment period, or loan term, dictates how long you have to repay the loan. Shorter repayment periods generally result in higher monthly payments but lower overall interest costs. Conversely, longer repayment periods lead to lower monthly payments but higher overall interest costs.

- Fees: Loan terms may include various fees, such as origination fees, late payment fees, and prepayment penalties. Be sure to understand all fees associated with the loan to accurately assess the overall cost.

- APR (Annual Percentage Rate): The APR reflects the total cost of borrowing, including interest rates and fees. It provides a comprehensive picture of the loan’s expense. Compare APRs from different lenders to make informed decisions.

Comparing Loan Options

When exploring personal loan options, it’s crucial to compare different offers based on interest rates, loan terms, and suitability for self-employed individuals. Consider the following:

- Online Lenders: Online lenders often offer competitive interest rates and streamlined application processes. However, they may have stricter eligibility criteria and limited options for personalized service.

- Traditional Banks and Credit Unions: Traditional institutions may offer more flexible loan terms and personalized support, but their interest rates might be higher than online lenders.

- Peer-to-Peer (P2P) Lending Platforms: P2P lending platforms connect borrowers with individual investors, potentially offering competitive rates. However, they may have more stringent requirements and a less established track record.

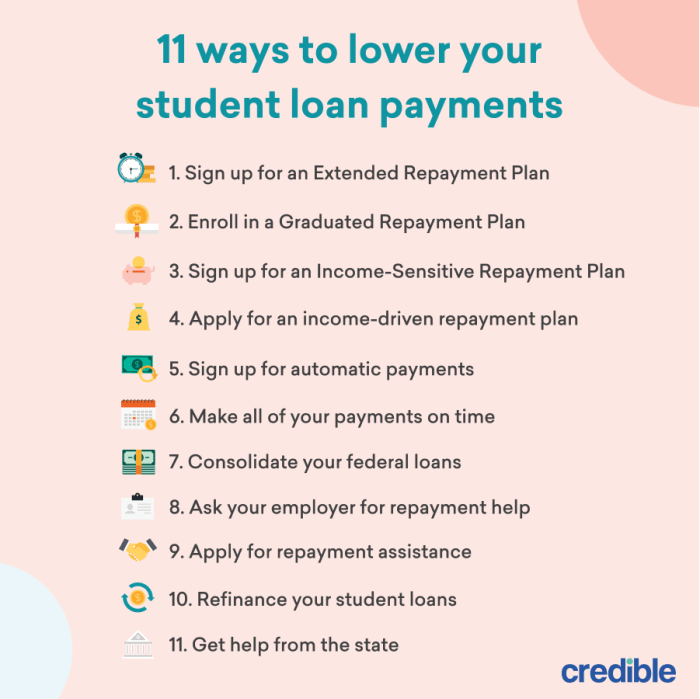

Managing Loan Repayments

As a self-employed individual, managing loan repayments can be a different ball game compared to someone with a steady paycheck. Income fluctuations are a reality, and you need to develop strategies to ensure timely payments while staying financially afloat.

Budgeting and Creating a Repayment Plan

The foundation of successful loan repayment lies in a solid budget. It’s essential to track your income and expenses, even when they vary month to month. This helps you identify potential financial gaps and plan for loan payments accordingly.

- Track Income and Expenses: Use spreadsheets, budgeting apps, or financial software to monitor your income from various sources, such as freelance projects, consulting fees, or business revenue.

- Categorize Expenses: Separate your expenses into essential (housing, utilities, food) and discretionary (entertainment, travel, subscriptions). This helps you prioritize spending and identify areas where you can potentially cut back.

- Create a Repayment Plan: Allocate a specific amount for your loan payments each month, even if your income is fluctuating. This could be a fixed percentage of your net income or a specific dollar amount that you can comfortably afford.

- Consider a Variable Payment Plan: Some lenders offer flexible payment options where you can adjust your payments based on your income. This can be helpful during periods of lower income.

Tools and Resources

Several tools and resources can help self-employed borrowers manage their loan repayments effectively.

- Budgeting Apps: Apps like Mint, Personal Capital, or YNAB (You Need a Budget) automatically categorize your transactions, track your spending, and provide insights into your financial health. They can also help you create and stick to a budget.

- Financial Advisors: A financial advisor can provide personalized guidance on managing your finances, creating a repayment plan, and navigating potential financial challenges.

- Loan Management Platforms: Some lenders offer online platforms or apps where you can track your loan balance, make payments, and access important documents.

Exploring Alternative Funding Options

While traditional personal loans might not be accessible to all self-employed individuals, there are other avenues to secure the necessary funds. If you’re facing challenges qualifying for a personal loan, exploring alternative funding options can be a valuable step.

Business Loans

Business loans are designed specifically for entrepreneurs and small business owners. These loans can be used for a variety of purposes, including covering operating expenses, purchasing equipment, or expanding your business.

- Advantages: Business loans typically offer larger loan amounts compared to personal loans, with potentially lower interest rates and longer repayment terms.

- Disadvantages: The application process for business loans can be more rigorous, often requiring detailed financial statements and a business plan.

Crowdfunding

Crowdfunding platforms connect individuals seeking funding with potential investors. This approach allows you to raise capital from a large number of people, often through online platforms.

- Advantages: Crowdfunding can be a viable option for individuals with a strong online presence or a compelling story to share. It can be a way to build community and generate excitement around your project.

- Disadvantages: Crowdfunding success is not guaranteed. You’ll need to actively promote your campaign and build a strong network of supporters.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers directly with individual lenders. This approach allows you to access funding without going through a traditional bank.

- Advantages: Peer-to-peer lending platforms often have more flexible eligibility requirements than traditional banks, making them a suitable option for self-employed individuals.

- Disadvantages: Interest rates on peer-to-peer loans can vary depending on your creditworthiness and the platform. You’ll need to carefully compare options and understand the terms of the loan.

Understanding the Legal Aspects

Securing a personal loan as a self-employed individual involves navigating specific legal considerations that are crucial for a smooth and transparent borrowing experience. It’s important to be aware of the relevant regulations and consumer protection laws that govern personal loans in your jurisdiction to ensure a fair and ethical lending process.

Key Regulations and Consumer Protection Laws

Understanding the legal framework surrounding personal loans is essential for self-employed borrowers. These laws are designed to protect consumers from unfair lending practices and ensure transparency in the loan process.

- Truth in Lending Act (TILA): This federal law requires lenders to disclose the terms of a loan, including the annual percentage rate (APR), finance charges, and other fees. This ensures borrowers are fully informed about the cost of borrowing.

- Fair Credit Reporting Act (FCRA): This law governs the collection, use, and disclosure of your credit information. It gives you the right to access your credit report and dispute any inaccuracies.

- Equal Credit Opportunity Act (ECOA): This law prohibits lenders from discriminating against borrowers based on factors like race, religion, or marital status.

- State Consumer Protection Laws: Many states have their own laws that further protect borrowers from predatory lending practices. These laws may address issues like loan fees, interest rates, and advertising.

Protecting Yourself from Predatory Lending Practices

Predatory lending practices target vulnerable borrowers with high-interest rates and unfair terms. As a self-employed individual, it’s essential to be vigilant and take steps to protect yourself.

- Compare Loan Offers: Don’t settle for the first loan offer you receive. Shop around and compare terms from different lenders to find the best deal.

- Read the Fine Print: Carefully review the loan agreement before signing. Understand the APR, fees, repayment terms, and any penalties for late payments.

- Be Aware of Red Flags: Watch out for lenders who pressure you into a loan, offer unrealistic promises, or use confusing or misleading language.

- Consider a Credit Union: Credit unions are not-for-profit institutions that often offer more favorable loan terms than traditional banks.

Related Loan Types

While personal loans are a common option for self-employed individuals, understanding other loan types can help you choose the best fit for your specific needs. This section will explore various loan types, their key features, and how they differ from personal loans.

Unsecured Loans

Unsecured loans are similar to personal loans in that they are not backed by collateral. This means the lender is taking a greater risk, which often translates to higher interest rates. However, they can be a good option for borrowers with good credit history and a stable income, as they are typically easier to qualify for than secured loans.

Commercial Loans

Commercial loans are designed for businesses and are often used for financing business operations, equipment purchases, or real estate investments. They typically require a more robust financial history and business plan, as well as collateral, which could include inventory, equipment, or real estate.

Student Loans

Student loans are specifically designed to help individuals finance their education. They are typically offered by the government or private lenders, and the repayment terms and interest rates can vary depending on the loan type and lender. While these loans are not directly related to self-employment, they can be relevant if you are considering continuing your education to enhance your business skills or knowledge.

Comparison of Loan Types

The following table summarizes the key features and differences between personal loans, unsecured loans, commercial loans, and student loans:

| Loan Type | Purpose | Collateral Required | Interest Rates | Eligibility Criteria |

|---|---|---|---|---|

| Personal Loan | Debt consolidation, home improvements, medical expenses, etc. | No | Variable, depending on credit score and loan terms | Good credit history, stable income |

| Unsecured Loan | Similar to personal loans, but can be used for business purposes | No | Typically higher than personal loans | Good credit history, stable income, strong financial history |

| Commercial Loan | Business operations, equipment purchases, real estate investments | Yes, typically required | Variable, depending on business financial history and loan terms | Strong business financial history, solid business plan, collateral |

| Student Loan | Financing education | No | Variable, depending on loan type and lender | Enrolled in an eligible educational program |

Securing a personal loan as a self-employed individual requires careful planning, thorough preparation, and a clear understanding of the lending landscape. By following the steps Artikeld in this guide, you can increase your chances of approval and access the financial support you need. Remember to research different lenders, compare loan terms, and choose the option that best suits your individual circumstances.

With the right approach, you can navigate the loan process with confidence and achieve your financial goals.

Common Queries

What if I have a low credit score?

While a good credit score is beneficial, some lenders may still consider applications from individuals with lower scores. You may be offered higher interest rates or require a co-signer. It’s essential to shop around and compare options from different lenders.

How long does it take to get approved for a personal loan?

Approval times vary depending on the lender and the complexity of your application. Some lenders offer quick approvals within a few days, while others may take several weeks. It’s best to contact the lender directly to inquire about their typical processing time.

Can I use a personal loan for business expenses?

While personal loans are generally intended for personal use, some lenders may allow you to use the funds for business purposes. However, it’s crucial to clarify this with the lender upfront to avoid any misunderstandings or penalties.