Unsecured personal loans offer a flexible way to manage unexpected expenses or fund personal goals. They’re a great option when you need a quick influx of cash but don’t have the time or resources to secure a traditional loan. However, it’s crucial to understand the risks and responsibilities associated with unsecured loans before diving in. This guide will help you navigate the world of unsecured loans, highlighting their potential benefits and offering tips for responsible borrowing.

From covering medical bills to tackling home repairs, unsecured loans can provide the financial support you need when life throws you a curveball. But before you take the plunge, it’s essential to consider your budget, credit score, and the terms of the loan. With careful planning and responsible borrowing practices, unsecured loans can be a valuable tool for achieving your financial goals.

Understanding Unsecured Personal Loans

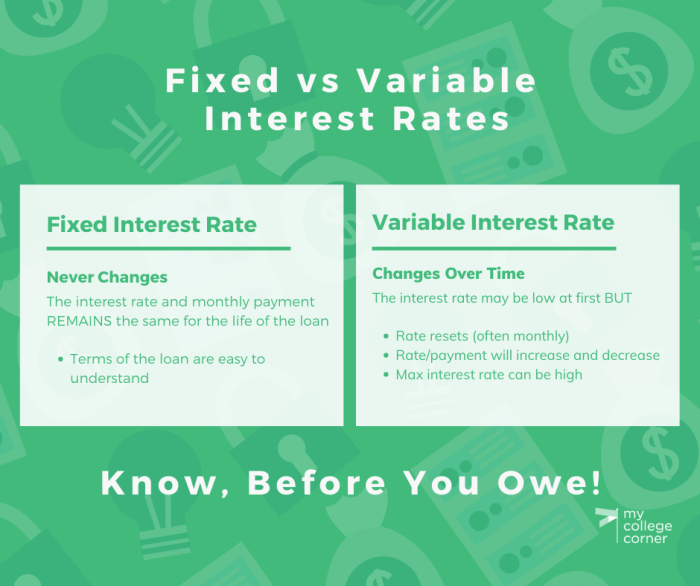

Unsecured personal loans are a type of loan that is not backed by any collateral. This means that the lender is taking on more risk than they would with a secured loan, which is backed by an asset such as a house or car. As a result, unsecured personal loans typically have higher interest rates than secured loans.

Key Characteristics of Unsecured Personal Loans

Unsecured personal loans are characterized by several key features:

- No collateral required: This means that the lender does not have the right to seize any of your assets if you default on the loan.

- Higher interest rates: Because the lender is taking on more risk, they typically charge higher interest rates on unsecured loans.

- Shorter repayment terms: Unsecured loans often have shorter repayment terms than secured loans, typically ranging from one to five years.

- Flexible use: Unsecured personal loans can be used for a variety of purposes, including debt consolidation, home improvements, medical expenses, and even vacations.

Comparison with Secured Loans

| Feature | Unsecured Loan | Secured Loan |

|---|---|---|

| Collateral | Not required | Required |

| Interest Rates | Typically higher | Typically lower |

| Risk to Lender | Higher | Lower |

| Loan Approval | May be more difficult to obtain | May be easier to obtain |

Advantages and Disadvantages of Unsecured Personal Loans

Unsecured personal loans can be a convenient and flexible way to borrow money, but it’s important to consider both the advantages and disadvantages before taking one out.

Advantages

- No collateral required: This is a major advantage for borrowers who don’t want to risk losing any assets.

- Flexible use: Unsecured personal loans can be used for a wide range of purposes.

- Quick approval: Unsecured personal loans can be approved relatively quickly, especially if you have good credit.

Disadvantages

- Higher interest rates: Unsecured loans typically have higher interest rates than secured loans, which can make them more expensive in the long run.

- Stricter eligibility requirements: Lenders may have stricter eligibility requirements for unsecured loans, making it more difficult for some borrowers to qualify.

- Risk of default: If you default on an unsecured loan, you may face negative consequences, such as damage to your credit score and potential legal action.

Responsible Borrowing Practices

Taking out an unsecured personal loan can be a great way to cover unexpected expenses or achieve financial goals. However, it’s crucial to approach borrowing responsibly to avoid overwhelming debt. Before you apply for a loan, take the time to plan and understand your financial situation to make informed decisions.

Budgeting and Financial Planning

Responsible borrowing begins with careful budgeting and financial planning. Before you even think about applying for a loan, take a close look at your income and expenses. This will help you determine how much you can comfortably afford to borrow and repay.

A budget is a roadmap for your finances, helping you track your income and spending and identify areas where you can save.

Creating a realistic budget involves listing all your income sources and tracking your expenses. You can use a spreadsheet, budgeting app, or a simple notebook to keep track of your spending. Once you have a clear picture of your financial situation, you can assess your ability to take on new debt.

Loan Affordability and Debt-to-Income Ratio

Determining loan affordability involves evaluating your debt-to-income ratio (DTI). DTI measures the percentage of your monthly income that goes towards debt payments. Lenders often use DTI to assess your ability to repay a loan.

DTI = (Monthly Debt Payments / Monthly Gross Income) x 100

For example, if your monthly debt payments are $1,000 and your monthly gross income is $5,000, your DTI would be 20%. A higher DTI indicates a greater financial burden, which can make it harder to get approved for a loan or secure a favorable interest rate. Aim for a DTI below 43%, as this is generally considered a healthy ratio.

Shopping Around for the Best Loan Terms

Once you’ve determined your affordability, it’s time to shop around for the best loan terms. Comparing offers from multiple lenders can save you a significant amount of money in interest charges over the life of the loan.

Interest rates and loan terms can vary widely between lenders.

Here are some tips for getting the best loan deal:

- Check your credit score: Your credit score plays a crucial role in determining the interest rate you’ll qualify for. A higher credit score usually translates to lower interest rates. You can get a free credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) once a year at AnnualCreditReport.com.

- Compare interest rates and fees: Don’t just focus on the advertised interest rate. Make sure to compare all the fees associated with the loan, such as origination fees, late payment fees, and prepayment penalties.

- Consider the loan term: A longer loan term will generally result in lower monthly payments but higher overall interest charges. Choose a loan term that balances your budget and minimizes your borrowing costs.

- Explore options for prepayment: Some lenders allow you to make extra payments without penalty, which can help you pay off your loan faster and save on interest. This option can be particularly beneficial if you anticipate receiving a lump sum of money in the future.

Alternatives to Unsecured Loans

While unsecured loans offer flexibility, they often come with higher interest rates and can negatively impact your credit score if not managed responsibly. Exploring alternative financing options can help you find a solution that better suits your needs and financial situation.Let’s delve into some common alternatives to unsecured loans, comparing their pros and cons to help you make an informed decision.

Credit Cards

Credit cards offer a convenient way to finance short-term expenses, allowing you to make purchases and pay them off over time. They are widely accepted, provide rewards programs, and offer flexibility in repayment. However, it’s crucial to use credit cards responsibly to avoid high interest charges and potential debt accumulation.Here’s a breakdown of the pros and cons of credit cards:

- Pros:

- Wide acceptance for purchases and services

- Potential for rewards programs, such as cash back or travel points

- Flexibility in repayment, allowing you to make minimum payments or pay off the balance in full

- Can help build credit history if used responsibly

- Cons:

- High interest rates, especially if you carry a balance

- Potential for overspending and debt accumulation if not used responsibly

- Annual fees for some cards

Credit cards are a suitable alternative to unsecured loans for smaller expenses that can be paid off quickly. If you have a good credit score and are disciplined with your spending, credit cards can be a valuable tool for managing your finances.

Personal Lines of Credit

A personal line of credit, similar to a credit card, provides a revolving credit line that you can access as needed. This flexibility allows you to borrow money only when you need it, making it an attractive option for unexpected expenses or short-term financial needs. However, interest rates can be high, and responsible usage is crucial to avoid debt accumulation.Here’s a closer look at the pros and cons of personal lines of credit:

- Pros:

- Flexibility to borrow money as needed, up to a pre-approved credit limit

- Lower interest rates compared to credit cards, but still higher than secured loans

- Can help build credit history if used responsibly

- Cons:

- High interest rates if you carry a balance

- Potential for overspending and debt accumulation if not used responsibly

- May require a credit check and approval process

Personal lines of credit are ideal for situations where you need access to funds quickly and for a short period. They can be a suitable alternative to unsecured loans for unexpected expenses, such as medical bills or home repairs.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with investors, eliminating the need for traditional financial institutions. This alternative financing option can offer lower interest rates and more flexible repayment terms than unsecured loans, but it’s crucial to carefully evaluate the platform and the borrowers before investing.Here’s a breakdown of the pros and cons of P2P lending:

- Pros:

- Potentially lower interest rates than unsecured loans

- More flexible repayment terms, including shorter terms and lower monthly payments

- Can provide access to financing for individuals with less-than-perfect credit

- Cons:

- Riskier than traditional loans, as investors are not protected by FDIC insurance

- May have higher origination fees than traditional loans

- Not suitable for all borrowers, as credit requirements can vary by platform

P2P lending can be a viable alternative to unsecured loans for individuals with good credit or who need financing for specific purposes, such as debt consolidation or home improvement.

Loan Types and Their Applications

Loans are a common financial tool used for various purposes, from funding education to purchasing a home. Understanding the different types of loans available and their specific applications can help individuals make informed decisions about borrowing.

Loan Types and Their Applications

- Personal Loans: These are unsecured loans, meaning they don’t require collateral. They can be used for a variety of purposes, such as debt consolidation, home improvements, medical expenses, or vacations. Personal loans typically have fixed interest rates and repayment terms ranging from a few months to several years.

- Student Loans: These loans are designed to help students finance their education. They are typically offered by the government or private lenders and have lower interest rates than personal loans. Student loans can be used for tuition, fees, books, and living expenses.

- Commercial Loans: These loans are intended for businesses and are often used to finance operations, purchase equipment, or expand operations. Commercial loans can be secured or unsecured and come with various interest rates and repayment terms depending on the lender and the borrower’s creditworthiness.

- Home Loans (Mortgages): These loans are used to finance the purchase of a home. Mortgages are typically secured loans, meaning the home serves as collateral. Home loans have fixed or adjustable interest rates and repayment terms that can span decades.

| Loan Type | Typical Interest Rate | Common Uses |

|---|---|---|

| Personal Loan | 6% – 36% | Debt consolidation, home improvements, medical expenses, vacations |

| Student Loan | 4% – 7% (federal) | Tuition, fees, books, living expenses |

| Commercial Loan | 5% – 15% | Business operations, equipment purchase, expansion |

| Home Loan (Mortgage) | 3% – 7% | Home purchase |

Unsecured personal loans can be a powerful financial tool when used responsibly. By understanding the benefits and risks, and taking the time to carefully evaluate your options, you can make informed decisions that align with your financial goals. Remember, it’s always a good idea to explore all available financing options before settling on an unsecured loan. With careful planning and a clear understanding of your needs, you can navigate the world of unsecured loans with confidence and achieve your financial aspirations.

FAQ Compilation

What is the difference between a secured and unsecured loan?

A secured loan requires collateral, such as a car or house, which the lender can seize if you default on the loan. An unsecured loan doesn’t require collateral, but typically carries a higher interest rate due to the increased risk for the lender.

How can I improve my chances of getting approved for an unsecured loan?

Maintaining a good credit score, demonstrating a stable income, and having a low debt-to-income ratio can increase your chances of approval. You can also shop around for lenders to compare interest rates and terms.

What are some common fees associated with unsecured loans?

Common fees include origination fees, late payment fees, and prepayment penalties. Make sure to understand all fees before signing a loan agreement.

What happens if I can’t repay my unsecured loan?

If you can’t repay your loan, the lender may take legal action to collect the debt. This could include wage garnishment or a lawsuit. It’s important to contact your lender as soon as possible if you are struggling to make payments.