Navigating the world of unsecured loans with fair credit can feel daunting, but it’s not impossible. Understanding the factors that influence your eligibility, and implementing strategies to improve your credit score, can significantly increase your chances of securing the loan you need. This guide provides a comprehensive overview of the process, from understanding the basics to exploring alternative financing options.

Securing an unsecured loan with fair credit requires a strategic approach. Lenders consider factors like your credit score, debt-to-income ratio, and income stability. While a lower credit score may lead to higher interest rates or stricter loan terms, there are steps you can take to improve your creditworthiness. Building a strong credit history, managing your debt responsibly, and exploring credit-building tools are essential steps in the journey.

Finding Unsecured Loan Options with Fair Credit

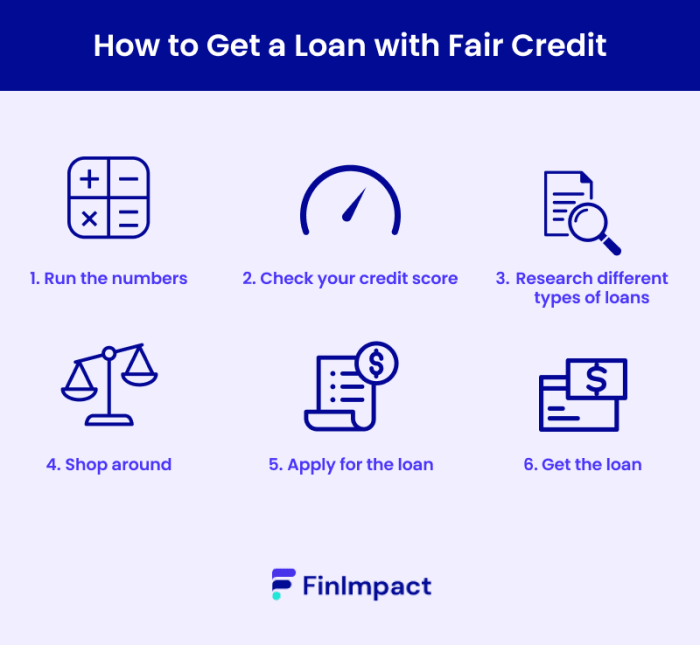

Securing an unsecured loan with fair credit can be a challenge, but it’s not impossible. Several lenders specialize in loans for borrowers with less-than-perfect credit scores.

Lenders Specializing in Fair Credit Loans

It’s essential to research and compare different lenders to find the best option for your needs. Some lenders that cater to borrowers with fair credit include:

- Online Lenders: These lenders often have more flexible eligibility requirements and may offer competitive interest rates. Some popular online lenders include LendingClub, Prosper, and Upstart.

- Credit Unions: Credit unions are known for their community focus and often offer more favorable loan terms to members with fair credit. They may have lower interest rates and more flexible repayment options compared to traditional banks.

- Banks: While some banks are more stringent with their credit score requirements, others may be willing to consider borrowers with fair credit. It’s worth contacting local banks to inquire about their loan options.

Comparing Loan Terms and Eligibility Requirements

When comparing loan offers, it’s crucial to consider the following factors:

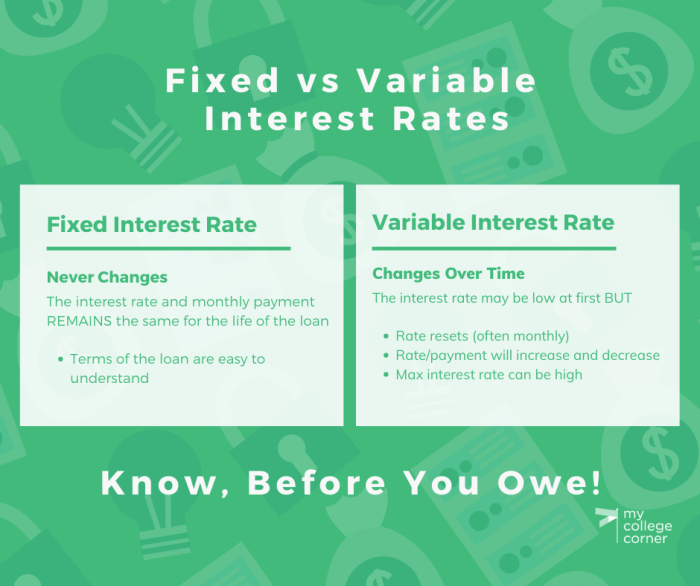

- Interest Rate: This is the cost of borrowing money. A lower interest rate will result in lower overall loan costs.

- Loan Term: This is the length of time you have to repay the loan. A longer loan term will result in lower monthly payments but higher overall interest costs.

- Origination Fee: This is a one-time fee charged by the lender to process the loan. It can range from 1% to 8% of the loan amount.

- Eligibility Requirements: Each lender has its own set of eligibility requirements, including minimum credit score, income level, and debt-to-income ratio.

Negotiating Favorable Loan Terms

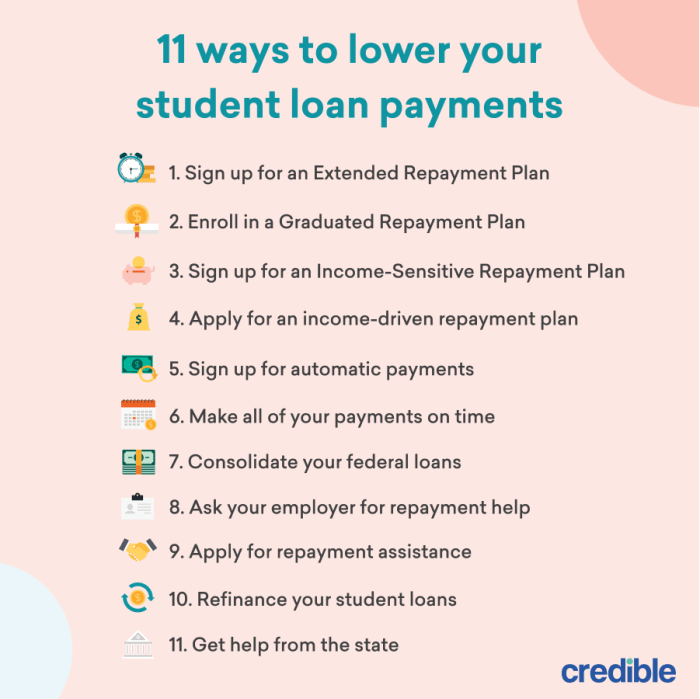

While you may not have much leverage with a fair credit score, there are still ways to negotiate better loan terms:

- Shop Around: Compare loan offers from multiple lenders to find the best rates and terms.

- Improve Your Credit Score: Even a small improvement in your credit score can make a difference in the interest rates you qualify for.

- Offer a Larger Down Payment: A larger down payment can reduce the loan amount and may help you qualify for a lower interest rate.

- Consider a Secured Loan: If you have assets you can use as collateral, a secured loan may have lower interest rates than an unsecured loan.

Exploring Alternatives to Unsecured Loans

If you’re facing challenges securing an unsecured loan with fair credit, it’s crucial to explore alternative financing options that might be more suitable for your situation. While these options may not always be as readily available or as convenient as traditional loans, they can offer a viable path to accessing the funds you need.

Alternative Financing Options

Exploring alternative financing options can provide you with more flexibility and potentially better terms, especially when dealing with fair credit. Here’s a closer look at some popular alternatives:

- Personal Loans from Family or Friends: This option offers a personal touch and can often come with lower interest rates or even no interest at all. However, it’s essential to approach this with caution, clearly outlining repayment terms and ensuring both parties understand the financial implications. A written agreement outlining the loan terms is highly recommended to prevent any misunderstandings or disputes down the line.

- Peer-to-Peer Lending Platforms: These platforms connect borrowers with individual lenders, often offering more flexible loan terms and potentially lower interest rates compared to traditional lenders. However, it’s crucial to carefully evaluate the platform’s reputation, interest rates, and loan terms before applying. Researching the platform’s security measures and user reviews can provide valuable insights.

- Credit Unions: Credit unions are member-owned financial institutions that often offer more favorable loan terms and rates, particularly for borrowers with fair credit. They may also have more lenient eligibility requirements compared to traditional banks. Joining a credit union and establishing a relationship with them can open doors to loan options that might be unavailable elsewhere.

Credit-Building Strategies

Building a solid credit history is essential for improving your chances of qualifying for loans in the future. Here are some effective credit-building strategies:

- Become an Authorized User on a Credit Card: If you have a trusted friend or family member with good credit, ask to be added as an authorized user on their credit card. This can help you benefit from their positive credit history, boosting your credit score over time. However, ensure you understand the responsibilities associated with being an authorized user, as any missed payments can negatively impact your credit.

- Secure a Secured Credit Card: Secured credit cards require a security deposit, which acts as collateral. These cards are generally easier to get approved for, even with fair credit. Responsible use of a secured credit card can help you build a positive credit history and eventually graduate to an unsecured credit card. Ensure you make timely payments and keep your credit utilization low to maximize the benefits.

- Pay Bills on Time: Consistently paying your bills on time is crucial for building a good credit score. Set reminders or use automatic payments to ensure timely payments and avoid late fees that can negatively impact your credit.

- Keep Credit Utilization Low: Credit utilization refers to the percentage of your available credit that you’re using. Aim to keep your credit utilization below 30% to maintain a healthy credit score. Avoid maxing out your credit cards and prioritize paying down balances to reduce your utilization ratio.

Loan Option Comparison

Here’s a table comparing different loan options based on credit score requirements, interest rates, and loan terms:

| Loan Option | Credit Score Requirements | Interest Rates | Loan Terms |

|---|---|---|---|

| Unsecured Personal Loan (Traditional Bank) | Good to Excellent (670+) | Variable, typically 5%-36% | 12-84 months |

| Peer-to-Peer Lending Platform | Fair to Excellent (620+) | Variable, typically 6%-36% | 12-60 months |

| Credit Union Personal Loan | Fair to Excellent (620+) | Variable, typically 5%-20% | 12-60 months |

| Secured Credit Card | Fair to Good (600+) | Variable, typically 15%-25% | Not applicable (revolving credit) |

Managing Debt and Maintaining Financial Health

Successfully navigating the world of unsecured loans with fair credit requires a strong understanding of debt management and financial health. It’s crucial to approach borrowing responsibly, and that means having a solid financial plan in place. Budgeting and financial planning are the cornerstones of managing debt effectively.

The Importance of Budgeting and Financial Planning

A well-structured budget is your roadmap to financial stability. It allows you to track your income and expenses, identifying areas where you can cut back or allocate funds more strategically. By understanding your spending habits, you can prioritize essential expenses and allocate funds for debt repayment.

Financial planning goes beyond budgeting; it encompasses setting financial goals, such as saving for retirement or a down payment on a house. By establishing these goals, you can create a plan that guides your borrowing decisions and helps you avoid taking on unnecessary debt.

Responsible Borrowing Practices

Borrowing responsibly is essential for maintaining financial health. Here are some key tips:

- Borrow Only What You Need: Avoid taking on more debt than you can comfortably repay. Calculate your debt-to-income ratio (DTI) to ensure you’re not overextending yourself. A DTI below 43% is generally considered healthy.

- Compare Loan Options: Shop around for the best interest rates and terms before committing to a loan. Compare offers from multiple lenders to find the most favorable conditions.

- Read the Fine Print: Carefully review the loan agreement, understanding the terms and conditions, including interest rates, fees, and repayment schedule.

- Build an Emergency Fund: Having an emergency fund can provide a safety net if unexpected expenses arise. This helps prevent you from relying on high-interest loans during financial emergencies.

Consequences of Defaulting on Loans

Defaulting on a loan can have serious consequences, impacting your credit score, financial standing, and future borrowing opportunities. Here’s a breakdown of the potential ramifications:

- Damaged Credit Score: A default will negatively impact your credit score, making it harder to secure loans or credit cards in the future, as lenders will view you as a higher risk borrower.

- Collection Agencies: The lender may turn the debt over to a collection agency, which can aggressively pursue repayment, potentially resorting to legal action.

- Legal Action: Lenders can take legal action to recover the outstanding debt, potentially leading to wage garnishment or the seizure of assets.

- Negative Impact on Future Borrowing: A default will be reflected on your credit report for several years, making it challenging to obtain loans with favorable terms in the future.

Seeking Professional Financial Advice

If you’re struggling to manage your debt or are unsure about your financial options, seeking professional financial advice can be beneficial. A financial advisor can help you create a personalized debt management plan, explore debt consolidation options, and navigate the complexities of your financial situation.

Understanding Different Loan Types

When exploring loan options, it’s crucial to understand the various types available and their key characteristics. This knowledge will help you make informed decisions and choose the loan that best suits your needs and financial situation.

Personal Loans

Personal loans are versatile financial tools that can be used for various purposes, such as debt consolidation, home improvement, medical expenses, or even a vacation. They are typically unsecured loans, meaning they are not backed by collateral.

- Purpose: Personal loans are designed to cover a wide range of personal expenses. They can be used for debt consolidation, home improvements, medical bills, or even major purchases like a new car.

- Eligibility Criteria: Lenders typically consider factors such as credit score, income, debt-to-income ratio, and employment history when assessing eligibility for a personal loan.

- Common Features: Personal loans usually have fixed interest rates and repayment terms ranging from a few months to several years. Some lenders may offer prepayment options without penalties.

Unsecured vs. Secured Loans

Understanding the difference between unsecured and secured loans is essential when considering loan options.

- Unsecured Loans: These loans are not backed by collateral. Lenders assess your creditworthiness based on your credit history and income. They typically have higher interest rates than secured loans due to the higher risk for lenders.

- Secured Loans: These loans are backed by collateral, which is an asset that the lender can seize if you default on the loan. Secured loans usually have lower interest rates than unsecured loans because the lender has less risk.

Other Loan Types

Besides personal loans, various other loan types cater to specific needs.

- Commercial Loans: These loans are specifically designed for businesses. They can be used for various purposes, such as working capital, equipment financing, or real estate acquisition.

- Student Loans: These loans are specifically designed to finance education expenses. They are typically offered by the government or private lenders and have different repayment terms and interest rates.

- Auto Loans: These loans are specifically designed to finance the purchase of a new or used car. They are usually secured loans, with the car serving as collateral.

- Mortgage Loans: These loans are specifically designed to finance the purchase of a home. They are secured loans, with the home serving as collateral.

Securing an unsecured loan with fair credit is achievable with careful planning and a commitment to improving your financial standing. By understanding the process, exploring available options, and implementing smart strategies, you can increase your chances of securing the financial resources you need. Remember, maintaining a positive credit history and managing your debt responsibly are key to achieving long-term financial stability.

General Inquiries

What is a good credit score for an unsecured loan?

While a higher credit score is always advantageous, a credit score of at least 670 is generally considered good for unsecured loan eligibility. However, individual lender requirements may vary.

Can I get an unsecured loan with a credit score below 600?

It’s possible to secure an unsecured loan with a credit score below 600, but you may face higher interest rates and stricter loan terms. Some lenders specialize in working with borrowers who have fair credit.

What are some tips for negotiating loan terms?

Shop around and compare offers from multiple lenders to find the best rates and terms. Consider negotiating a lower interest rate, longer repayment period, or lower origination fees. Having a good credit history and a solid financial plan can strengthen your negotiating position.